App Stores give carrier billing a new lease of life

by Sukey Miller

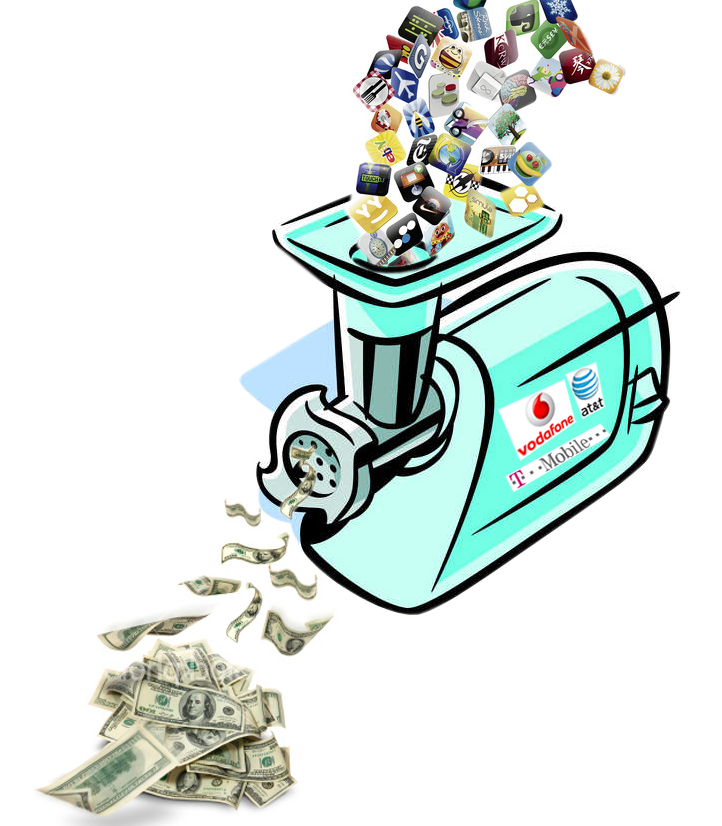

Just when you thought that the dominance of the App Store had relegated carriers to little more than a marketing channel for Apple devices, and that SMS as a charging model for wallpapers and ringtones had been regulated into oblivion, carrier billing is on the rebound.

Just when you thought that the dominance of the App Store had relegated carriers to little more than a marketing channel for Apple devices, and that SMS as a charging model for wallpapers and ringtones had been regulated into oblivion, carrier billing is on the rebound.

Variously dismissed as irrelevant, inconsistent, restrictive, expensive, risky, over-regulated and under-performing, you’d be forgiven for thinking that carrier billing had imploded as a strategic choice for mobile commerce. You’d be wrong.

Bango has been monitoring carrier-billed payments through our own platform, and talking to carriers and app store providers about the role of charge-to-bill payments for sales of digital content. Bango’s in-house analysis shows that carrier billing delivers 8 out of 9 of all payments when it is available to app store customers, compared to just offering something like PayPal. In some markets it is impossible to reach more than 5% of smartphone users unless carrier billing is offered as the default method of payment – this includes Germany, South Africa, the Emirate states.

This point is not lost on the big carriers like Vodafone Group, AT&T, T-Mobile, Telefonica, AMX etc. In August, Vodafone’s Group Commercial Director, Tobin Ireland, commented that offering carrier billing within BlackBerry App World now results in 70% of customers choosing to pay on their Vodafone bill.

Today, BlackBerry App World and Nokia Store are the most carrier-connected app stores, allowing customers to pay for downloads and make in-app charges to phone bills worldwide. In the background, Android Market is slowly adding carrier billing as an option in the Google Checkout process, while Microsoft is making similar moves with its Windows Marketplace store. Other device makers are also keen to reap the benefits of more sales through carrier billing.

Bango recently launched global billing for the Opera Mobile Store, which makes payments fast and simple through a browser based checkout flow. The addition of carrier billing has already added significant new customer numbers, creating meaningful additional revenue for Opera’s developers.

The cost of carrier billing is often questioned. While it is certainly more expensive to process payments to a mobile phone bill than credit card or PayPal payments, carrier billing is so much more effective than either that the difference in revenue share is more than compensated by the total number of payments the developer will receive.

The latest app store models with in-app billing SDKs has afforded Bango some success negotiating ever improving terms of business with carriers, particularly for partners where all parts of the proposition, marketing, customer interaction, care and merchant settlement are managed through the Store Provider-Bango partnership. The carrier has little more to do to make money than process lots of billing requests.

Carriers have found a perfect role enabling users to be identified and billed easily and securely through their phone bills,” said Ray Anderson, Bango CEO. “Carrier networks are connecting an increasing number of mobile platforms – smartphones, tablets, handheld gaming devices, book readers and laptops all carry SIMs these days – and carriers are realizing that there is a lucrative business acting as the billing channel for payments made from these devices”.

Will Apple ever embrace carrier billing? “Of course”, says Ray Anderson, “as soon as they decide it’s ok to share more with carriers as a quid pro quo for tapping a bigger and younger audience. As RIM will soon show with its BlackBerry Cloud Music Service, carrier billing is highly effective for monetizing content used on the mobile device”.

![]()

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.