Digital subscriptions market to nudge $600 billion by 2026, says Juniper Research

by Ben Caveen

Bango’s “de facto standard” for Super Bundling is pivotal for telcos that want a growing share of revenues

The number of global digital subscriptions is expected to explode in the next couple of years as demand for digital music and streaming services continues to gather pace.

That’s just one of the conclusions of a new whitepaper published jointly by Juniper Research and Bango, which found that the number of digital subscriptions looks set to hit 4.2 billion by 2026 — an eye-popping jump of over 210% over eight years.

In financial terms, the scale of the rise is even more of a game-changer, with Juniper predicting the digital subscriptions market could be worth almost $600 billion by 2026 — up from $100 billion in 2018.

The whitepaper — How Telcos Must Capitalize On The Super Bundling Opportunity — found that this 495% market growth over just eight years, driven by an insatiable appetite for digital services, is also fueling a new market for ‘Super Bundles’ that will centralize the management of, and act as a storefront for, subscription services.

Given the current climate in the telecoms industry — with declining ARPU (Average Revenue per User) and increasing customer acquisition costs — the Juniper report finds that Super Bundling offers telcos a unique opportunity to make customer acquisition easier, reduce churn and strengthen brands that are prepared to innovate.

Commenting on the growth predictions for digital services, Sam Barker, Head of Analytics & Forecasting at Juniper Research, said: “There is one evident takeaway [from our research]: there are obvious and immediate opportunities for telcos to capitalize on this growth. This will be done by offering Super Bundling services to mobile subscribers.”

Telcos are the bridge that links consumers and digital service providers

Juniper argues the established interface between consumers and service providers gives telcos a unique position in the rapidly evolving subscriber economy.

“There are many aspects in which Super Bundling can provide benefits to consumers, and telcos must position themselves as the ‘bridge’ between mobile subscribers and service providers to capitalize,” said Juniper.

But telcos’ position in the market — as trusted brands with billing relationships that span millions of customers — is only part of the equation. If they’re to change tack from a subscription-focused model to one that revolves around subscribers, they need to move fast.

Why? Because as Juniper points out, the market for subscriptions is set for continued growth in the next couple of years and telcos simply don’t have time to waste.

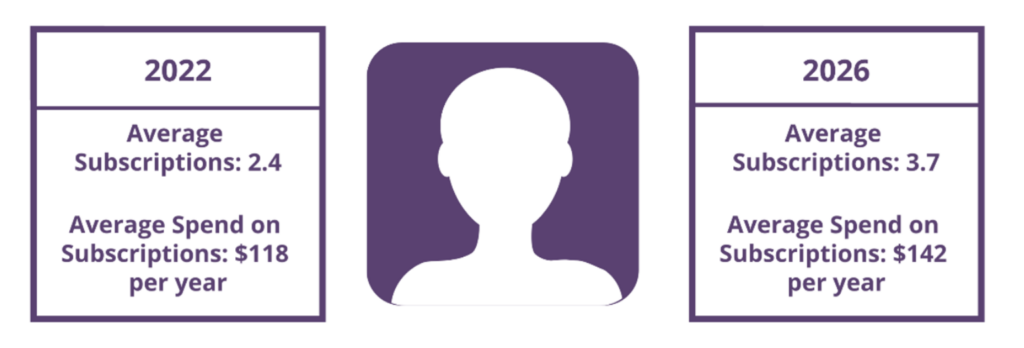

Average global subscription service growth. Source: Juniper Research

“The onus is on the telcos to offer these services to maximize benefits for their mobile subscribers. The first step to achieve this is creating the tools for subscription management for the subscribers,” said Juniper.

Bango enables Super Bundling

As Juniper makes clear, Bango is already providing those “tools” — a solution that enables telcos to develop their own Super Bundling solutions quickly and at scale.

The concept behind the technology is akin to a Digital Vending Machine (DVM) that can be used to create, launch and manage dozens of subscriptions — such as Netflix, HBO, Amazon Prime, Microsoft 365 & Xbox Game Pass, Duolingo, Calm, Peloton, McAfee — and other subscription services for their customers.

This DVM enables the world’s leading telcos to offer their customers dozens of subscription services bundled with their own first-party services. Indeed, Juniper is already describing the Bango technology as the “de facto standard for powering this business.”

The telcos that are making use of DVM technology have recognized the shift in consumer behavior and how they can best capitalize on the predicted surge in demand for digital subscriptions on their terms. And by taking advantage of Bango’s DVM they have been able to respond to these trends in the moment.

Juniper’s analysts are clear about the opportunities and how Super Bundling can tap into this growing market. It’s now up to telcos to respond or risk missing out on their share of the burgeoning $600 billion sector.

To find out more about the future of subscriptions and Super Bundling read the full Juniper Research report, which will also give you insights into:

- The biggest and fastest-growing subscription categories

- How telcos can benefit from Super Bundling with easier customer acquisition and increased customer retention

- Super Bundling / Subscription hub case studies with two of the world’s biggest telcos

You can download ‘How Telcos Must Capitalize On The Super Bundling Opportunity’ whitepaper here.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.