MEF Connects Indonesia: What will be big for mobile in 2017?

by Sukey Miller

Bango spoke at the recent MEF Connects event in Jakarta, Indonesia joining the panel session to discuss hot trends in the mobile space, mobile payments as a whole and the ‘next wave’ for the Indonesian mobile ecosystem. Here are the highlights from the event.

Randy Pangalila, Group Head of Mobile Financial Services at Indosat Ooredoo opened the event at the stunning Grand Hyatt hotel Jakarta with a keynote speech on the Indonesian smartphone market, particularly highlighting the stunted growth of banking. With a 2% Year on Year growth of credit card penetration, a total of 3.2% of the population owning a credit card, the lack of banking in the region has limited the options, or even made users unable to participate with the digital ecosystem. Randy led with an anecdote of losing his ATM card 2 years ago which he is yet to replace, the Indonesian market has moved beyond banking, the country has become cash and e-money reliant. Alternative payment options are opening, with a range of mobile payments solutions such as Direct Carrier Billing, or Indosat’s own mobile wallet solution Dompektu easing the issues of the banking system and allowing Indonesian users to pay for digital content seamlessly.

Randy brought his talk to a close by highlighting the astounding levels of smartphone growth in Indonesia, with 43% of the population owning a smartphone device. The future is bright for the Indonesian smartphone market, with mobile payments taking the nation by storm. Leaving the stage on a positive note, Randy handed over to the compares from Mobile Monday to bring myself and the rest of the panel up to the stage.

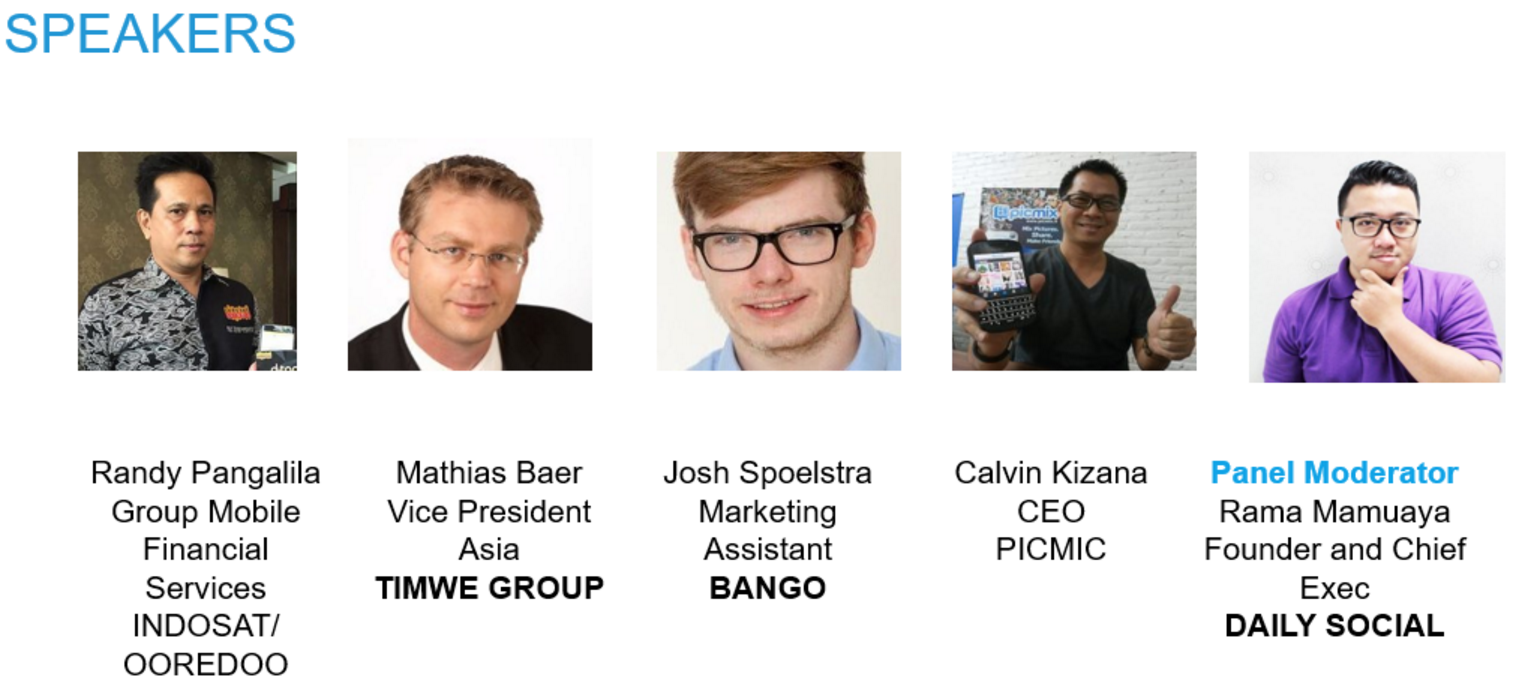

Rama Mamuaya, Founder of Daily Social moderated the panel session which featured representatives from TIMWE, Picmix, Indosat and Bango:

The panel focused on two broad topics. ‘What was hot in 2016?’ and ‘What will be the big topic of 2017?’. Discussion and debate were free flowing, each representative had strong views on the highlights of 2016, but all agreed that content reigned king, especially in the app stores. Apps are now disrupting legacy industries in the region such as retail, video and entertainment, as the highly smartphone savvy, engaged audience of Indonesia begin to integrate into a digital heavy ecosystem. App store content such as Pokémon Go and the ‘Clash’ series of games generated $89billion USD for developers across the Google Play and Apple App Store in 2016.

The panel also covered the rise of FinTech in Indonesia, with a number of start-ups mirroring successes of UK and American companies in the local markets, a conversation which carried over into the second part of the panel…

What will be the big topic in 2017? The panel moved swiftly on, going straight back into the ‘next wave’ for the market, which was unanimously agreed to be the payments wave. The Fintech start-up market is beginning to reach its peak and turn into maturity, the next wave of e-commerce and the availability of payments will take FinTech and the wider digital space of Indonesia to even greater heights. End users have access to smartphones, they are beginning to see a host of local and overseas content coming into the space, especially in app stores. But as Randy mentioned in the keynote, payment options are limited. 2017 will see a monumental rise in alternative payment methods, enabling end users to fully experience and enjoy the vast range of digital content and services available to them, creating a new wave to stimulate both local and international growth in the Indonesian market and the worldwide space.

Overall, MEF Connects Indonesia highlighted the ongoing evolution of the Indonesian market as a whole, with the ‘next wave’ of payments set to be a driving force of the country’s developing FinTech footprint.

For more information on the MEF Connects Indonesia event, please contact sales@bango.com

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.