Subscription Wars: Super Bundling Awakens

This report includes data from 5,000 US subscribers, exploring their attitudes, behaviors, and the changing nature of the subscription economy.

A long time ago…

For over 20 years, the subscription wars have raged across the galaxy. From streaming services to gaming platforms, fitness trackers to educational apps, content providers have fought fiercely over the most precious resource in the universe – subscribers.

Each year, Bango Subscription Wars research examines this great battle for new and repeat subscribers. In 2023, we explored the rebellion against costly and fragmented services. Now, in 2024 the world has changed once again. Password crackdowns, ad-funded tiers, and new pricing models represent a fundamental change in how content providers compete.

For subscribers, indirect subscriptions are becoming the new normal. From cross-platform bundles like Prime with Paramount+, to multi-service subscriptions like Uber One, a fragile peace is being established. And at the heart of this peace, a new force is awakening – Super Bundling.

With the launch of all-in-one content hubs like Verizon +play and Optus SubHub, content providers that once competed are finally joining forces to share subscribers and build better experiences for all.

But is this the future that subscribers want? And will this finally end the subscription wars for good? Read on to find out.

Methodology

This report includes data from 5,000 US subscribers, exploring their attitudes, behaviors, and the changing nature of the subscription economy. Commissioned by Bango and conducted by independent research agency 3Gem, the Subscription Wars: Super Bundling Awakens research was conducted in Dec 23 – Jan 24 and published in February 2024.

In this report, you’ll discover

- The changing face of the subscription wars, and the impact on subscribers

- How competition, price increases, and password crackdowns have impacted the subscription economy

- Why indirect channels are becoming the go-to way for subscribers to sign up

- Why Super Bundling continues to rise, and who will lead this revolution

1. State of subscription – Rising star or supernova?

The type and variety of subscriptions on offer has exploded over the last twelve months, with new players entering the market and new categories of subscriptions emerging.

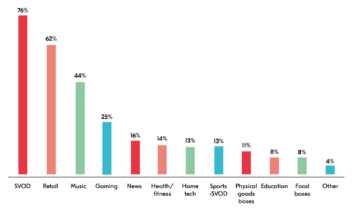

The average subscriber now has 4.5 subscriptions, while 10% have 10+ and 2% have 15+. Currently, 62% of US subscribers have a retail subscription, 25% have a gaming subscription, 16% have a news subscription, while 13% have a home tech subscription.

Amongst this variety, Streaming Video on Demand (SVOD) remains the center of the universe, proving the most popular consumer subscriptions in 2024. 76% of those surveyed currently pay for at least one video streaming platform.

As an opportunity for growth, the marketplace has never looked healthier. But, if content providers are going to take advantage, they need new ways to reach subscribers. Content quality and direct sign ups are no longer enough.

As competition ramps up, the focus must switch to great customer experiences, giving subscribers control, flexibility, and choice.

2. Competition, crackdowns and price hikes

As the war for new sign ups has grown fiercer, so too has the drive towards monetizing each subscriber as effectively as possible. Most recently, subscription services have achieved this through increased fees, and crackdowns on password sharing.

This monetization has been a resounding success from the perspective of subscription services. The average American subscriber now pays a stellar $924 per year for subscriptions ($77 per month). A quarter (25%) pay $100 per month, while 1 in 20 pay over $200 per month — that’s more than $2,400 a year!

The much-publicized crackdown on password sharing among SVOD services such as Netflix is only one example of a broader trend, helping drive a boom in new sign ups. In fact, since the password crackdown, 35% of American subscribers are now paying for a service that they previously accessed for free.

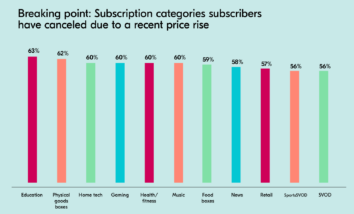

However, there is a limit. According to our data, continued increases may lead to certain consumers being unable to afford their subscriptions, as over half of subscribers (57%) have discontinued their subscriptions because of unanticipated price hikes.

Average total spend per year on subscriptions

have canceled a subscription due to recent price hikes

can’t afford all the subscriptions they would like

TREND: Parents pay out

Not everyone is paying for subscriptions on equal levels. Our data reveals that parents, for example, pay $83.40 per month on subscriptions, almost 10% more than the average subscriber’s monthly bill ($77).

With the launch of child-specific streaming services such as HappyKids and ABCmouse, parents are a key market for subscriptions. But it’s not just about SVOD, 1 in 10 parents have also signed up to education subscriptions, an increasingly essential resource for school work.

3. Indirect sign ups – A great deal

As subscription expenditure rises, many subscribers are on the hunt for the best possible deals, looking for new cost effective ways to sign up to their favorite subscriptions.

As a result, indirect subscriptions have become a major market in 2024, with combined subscriptions, bundles, and third-party selling all proving essential drivers of growth.

1 in 5 subscribers (20%) now sign up exclusively via indirect means, avoiding the traditional, direct subscription process. A third (34%) subscribe via another service they already pay for.

These indirect subscription methods are providing a great way for subscribers to secure the best deal, with 29% now receiving their subscriptions for free as part of a bundle.

If content providers want to secure new customers in 2024, they can’t rely on direct sign-ups alone. Bundling and other indirect methods will be vital for driving customer acquisition.

4. Subscribers take control

As the number of subscriptions per person booms, it’s no wonder subscribers are finding it hard to manage all their disjointed services.

Half of those surveyed (49%) are annoyed that they can’t manage all their subscriptions in one place, and 44% say it’s become too hard to keep track.

Simply having choice is no longer enough, subscribers want to take control. That means two things — greater flexibility of services, and more transparency into their monthly bills.

TREND: The rise of Forever Subscriptions

Despite many subscribers jumping between different services, 75% have one subscription that they will never cancel or even pause. This rarefied status of the ‘Forever Subscription’ represents the ultimate goal for content providers looking to land a lifetime subscriber.

But ‘Forever Subscriptions’ aren’t for everyone. Those with SVOD subscriptions are the most likely to have a service they are committed to, followed by those with retail subscriptions. In contrast, education and physical box delivery subscribers are the most fickle, regularly jumping between platforms.

Flexibility

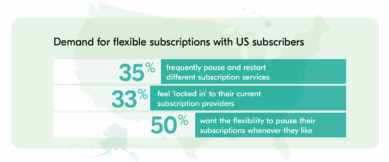

Flexibility is a must for subscription services in 2024. Over a third (35%) of subscribers regularly pause and restart subscriptions, citing flexibility as a top priority when signing up.

Despite this, 33% still feel ‘locked in’ to their current providers. As a result, more flexible approaches, such as tiered subscription models, are proving essential for winning over new subscribers.

Services that have launched a free ad-funded tier have generally been met with a positive reception. However, attitudes quickly change when paid-for subscriptions start incorporating ads. 78% of those surveyed say they strongly object to paid subscriptions featuring ads, while 31% have canceled a paid subscription when ads were introduced.

of subscribers have canceled a subscription due to ads being introduced

of subscribers have upgraded a subscription since an ad-supported version launched

have downgraded a subscription since a cheaper ad-supported version launched

Transparency

Transparency is vital for subscribers in 2024, especially when it comes to their monthly bills. With so many subscriptions on the go (some paid, some free, some ad-funded, some on a trial), over a third (35%) have lost track of how much they’re spending.

Not only does this make it hard to manage expenses, it also damages the subscriber experience. 32% say they’re consistently frustrated with how they currently manage and pay their subscription bills.

As such, many are looking for a simple, flexible, centralized way to pay — across all of their content providers and subscriptions.

of subscribers are frustrated by how they currently pay their subscription bills

don’t know how much they’re spending each month on subscriptions

TREND: Vampire Subscriptions

As the number of subscription services increases, consumers are rapidly losing track. The result? Vampire Subscriptions are on the rise.

Vampire subscriptions are those services that consumers no longer need but have forgotten to cancel, sucking money out of their accounts.

36% of American subscribers have at least one paid service that remains unused. This statistic worsens when considering the younger demographic, as a staggering 50% of Generation Z subscribers have at least one subscription they do not use.

A lack of transparency around billing is making it hard for subscribers to avoid these costs, limiting the money available for subscriptions they really want.

5. Subscription fatigue, and the rise of content hubs

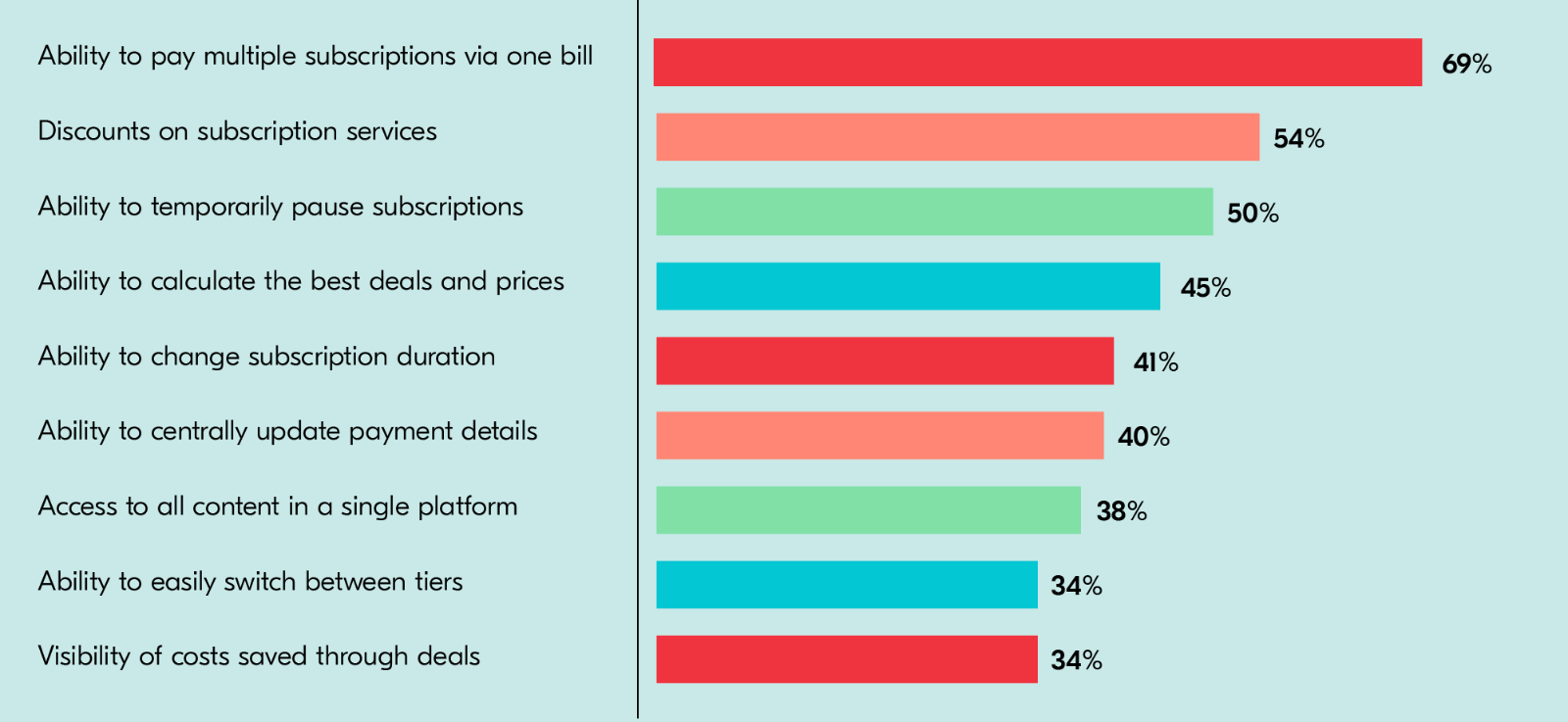

As subscribers look for greater flexibility and transparency, many are turning to content hubs – single centralized platforms putting multiple subscriptions under one roof. Nearly three-quarters of subscribers (73%) want to access and manage all of their subscriptions via this sort of all-in-one hub.

But this isn’t just about convenience. It’s also about landing the best possible deals, with more than half of subscribers (54%) expecting to receive a discount on subscriptions when bundled in this way.

want a single content hub for subscriptions

want the ability to pay multiple subscriptions via one bill

expect content hubs to provide a discount on subscriptions

Top features subscribers want from a content hub

6. Super Bundling – The key to content hubs

The rise of Super Bundling (the bringing together of multiple subscription products that can be paid for and managed in one content hub) is permanently altering the subscription landscape, to the benefit of consumers. By enabling all-in-one subscription platforms, Super Bundling has proven itself to be a powerful way to provide consumers with:

Flexibility | Control over apps, subscriptions and bills |

Transparency | Visibility into subscriptions and bills |

Centralization | An easy way to connect multiple content providers into one hub (and for content providers to access new audiences) |

Creating centralized hubs that prioritize subscriber preferences is not only what’s best for consumers but also what’s best for content providers and subscription services.

Content companies like Netflix invest heavily in growing and preserving their user base to retain a competitive advantage. Leveraging subscriber-focused central hubs for subscriptions unlocks important new channels for distribution and fosters an even larger base of devoted customers.

If subscriber demands aren’t met, there is a risk that they turn away from legitimate content providers for good. Almost a third (28%) of those surveyed say online piracy is the only way to access all of the content they want in one place.

want the ability to pay for multiple subscriptions via one monthly bill

want one app to manage all subscriptions services and accounts

TREND: Content hubs, not cable packages

It’s often said that the bundled subscriptions model is simply a return to pre-paid cable TV packages. In reality, new content hub models offer far greater flexibility. In the case of Optus SubHub, an Australian subscription platform, users have the flexibility to select their own subscriptions, toggle services on and off, and pause and return to content as they see fit. This ‘build your own’ approach is proving much more popular, with 69% of subscribers saying they want to pick and choose their bundled services rather than receiving a pre-packaged ‘cable TV-style’ selection.

7. Who is leading the Super Bundling revolution?

Back in 2023, many subscribers saw bundling as an evolution of cable television for the streaming age. As such, the majority expected cable companies to lead the charge when it came to developing and launching these all-in-one content hubs.

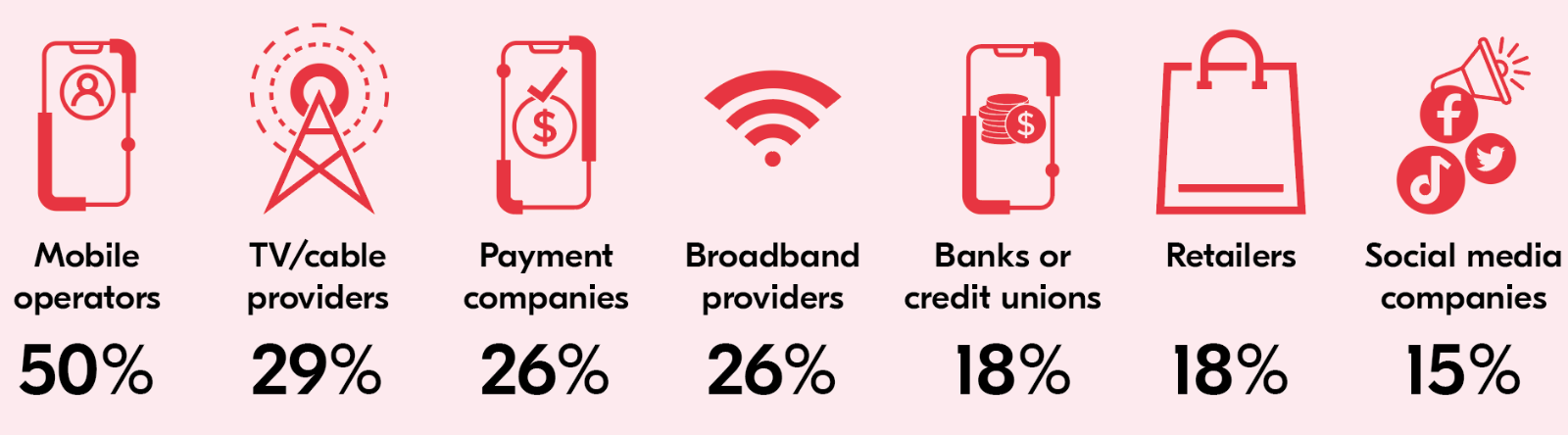

In 2024, the landscape has shifted with many consumers now looking beyond streaming services for more inclusive all-in-one subscription platforms. Telcos have fast become the go-to choice for Americans looking to centralize their subscriptions. In fact, half of those surveyed (50%) now want their mobile operators to offer a single platform to manage and bill all their subscriptions in one place.

If a telco were to develop a content hub, the majority of subscribers (61%) would be happy to pay for it. In fact, the 19% of subscribers would pay 50%+ on their monthly bill, if their favorite subscriptions were included in the price — equivalent to an extra $364 per year*.

This provides a golden opportunity for telcos to lead this revolution, using Super Bundling technology to connect content providers, give subscribers the benefits they want, and redefine the subscription economy.

*Based on the average US monthly mobile phone bill.

want telcos to provide a single platform for all subscriptions

would pay a higher monthly mobile/internet bill if subscriptions were bundled

would pay 50%+ on their monthly bill if subscriptions were included

Who should own Super Bundling?

8. Super Bundling – Win, win, win

For telcos such as Verizon in the US, creating content hubs is a win for everyone involved — subscribers, content providers and the telcos themselves.

Telcos win

Subscribers are crying out for telcos to take control of the disjointed subscription market. Those that do, will be rewarded with customer growth, higher revenue per customer, and greater loyalty.

Content providers win

Subscribers will spend more time engaging with their subscriptions, and subscription bundling will drive new customer acquisition and expansion of the overall market. Content providers can spend less on marketing and more on providing great content. Customers can try out services without fear of “lock in”.

Subscribers win

Subscribers ultimately get what the data in this report says, that they want. More flexibility, more transparency, and better control over costs and content.

9. Where do I start?

Content providers

Super Bundling gives content providers instant access to a ready-made distribution, marketing and billing network offered by telcos and other channels around the world. Bringing together telcos and content providers in one place, the Digital Vending Machine® from Bango is a SaaS product that enables the Super Bundling of content subscriptions.

Several global telcos have already created their own vibrant content hubs – bringing together dozens of providers including Netflix, ESPN, Amazon Prime, Duolingo, YouTube, Peloton, Audible and more in one seamlessly integrated solution.

The Digital Vending Machine® from Bango isn’t just for established players. The low barrier to entry means it’s ideal for content and service providers looking to make a name for themselves. Plus, it opens doors to some of the biggest reseller networks around including telcos, banks and retailers. Support for a range of commercial models means that the Digital Vending Machine® from Bango ensures you get to market at speed and with minimal integration pain.

The Digital Vending Machine® from Bango brings together resellers and content providers to enable Super Bundling of subscriptions at speed and scale.

Telcos

The Digital Vending Machine® from Bango is loaded with pre-built integrations for hundreds of subscription products, apps, and streaming services. We provide all the core requirements via standardized technology enabling telcos to deliver Super Bundling in months, rather than years.

The Digital Vending Machine® from Bango is available as a SaaS product, which means telcos can quickly and easily scale, gaining access to a constantly evolving and growing ecosystem of global subscription and content providers. This happens through a single one-to-many integration, avoiding time-consuming one-to-one arrangements.

Enabling this super-fast time to market means that telcos can focus on the things that matter most to them: customer acquisition, retention and engagement. Developing subscription hubs with Verizon and Optus, we’ve helped create deals spanning Netflix, ESPN, Amazon Prime, Duolingo, YouTube, Peloton, Audible and more.