Super Bundling: How music streaming services can cut through the noise with one key differentiator

by Giles Tongue

In a crowded market, how can music streaming services ensure they stay top of the charts? Our survey of 2,200 US music streamers reveals the emerging consumer challenges that will demand new attitudes to collaboration, and indicates how Super Bundling can play a central role to driving up subscriptions.

With global streaming earnings of $19.3 billion, 713 million subscribers and an 84% share of industry revenue in 2023, the disruption and dominance of music streaming today is one of the biggest success stories of the subscription economy. And with a predicted rise in revenue of nearly $15 billion in the next three years, music platforms will likely be feeling confident in their ability to secure future subscribers.

But what this paint-by-numbers picture doesn’t show is the unique position of music streaming in the evolving subscriber landscape. Unlike sports, TV and other popular subscriptions, licensing agreements with record labels mean that the content from different platforms is near-identical. With the exception of a few unique features, the core listening experience stays overwhelmingly the same.

With differentiation hard to come by, music platforms are looking to rapidly innovate and diversify. In the case of market leader Spotify – who recently reported a 14% rise in paid subscribers in Q1 of 2024 – this has meant a major expansion into audiobooks and podcasts. For others, it means investing heavily in user experience and a wider variety of tiered subscription plans. Of course, with all this innovation, comes an increase in cost.

So just how have subscribers responded to these changes? Our new survey of 2,200 US music streamers provides some answers…

Music subscribers risk pressing pause

Last year, almost every major music platform increased its fees, with further price hikes planned for the coming months. Faced with these rising prices — and more subscriptions to choose from — two-thirds of music streamers (66%) say they can no longer afford all of their subscriptions.

Instead, many must now pick and choose between streaming TV, music, gaming and other services, with 60% having canceled at least one subscription to afford the rising prices. More than a third (39%) have also downgraded at least one of their subscriptions to a cheaper, ad-funded tier.

Forced to pick and choose between subscriptions, music streamers are becoming ever more discerning. Streaming providers face the challenge of not only enticing new customers from competitors but retaining their existing ones, too. Marketing budgets soar and profit margins shrink as competing platforms try to stay ahead in a difficult economy. Faced with these challenges, music platforms can’t afford to enter a race to the bottom by lowering prices.

All together now

So what options remain for music streaming services seeking that competitive edge? In-house bundling is one way the big players are trying to tempt subscribers into the fold, providing an instant point of differentiation. There’s Amazon Music with Prime Delivery. Apple Music as part of Apple One. YouTube Premium provides ad-free access to YouTube Music.

But is the convenience of next-day delivery enough to convince a subscriber to ditch their current music streaming account? Do users resent being locked into one streaming ecosystem? And what happens to smaller providers that don’t have that range of services to sell?

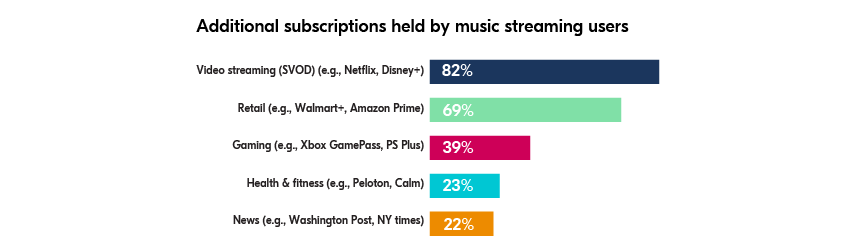

This is where Super Bundling presents companies with an opportunity to deliver added value to subscribers. Super Bundling is a way of packaging together subscription providers into one single offer for the customer. Think music plus movies, music plus gaming, or music plus meditation. The propositions are only limited to the huge variety of subscription services out there.

In the key of Super Bundling

Over the next 12 months, we predict that Super Bundling will go stratospheric as more and more consumers are attracted by the freedom and flexibility of consolidated subscription management and billing.

Eight in ten music streaming subscribers (80%) are now pushing for one single app that combines their music service with various other subscriptions. More than half (54%) would also like to use this type of Super Bundling as a way to secure cross-platform discounts, while over three quarters (77%) believe Super Bundling could ultimately help them manage their expenses and deal with rising costs.

When it comes to who should offer this type of all-in-one package, music subscribers also have a clear answer: 60% want their cell phone provider to lead the charge, while 58% say that they would be willing to pay a higher monthly bill if this service was provided.

Our CMO, Anil Malhotra, believes Super Bundling is the key to unlocking subscriber growth in both new and developed markets:

“Our research has shown a clear demand from subscribers for third-party subscription management – by joining a Super Bundling solution, music subscriptions can address this need by making their platforms available inside third-party content hubs like Verizon +play.

“Already Verizon is offering the live music service VEEPS and concert streaming platform Qello Concerts from Stingray as part of its +play platform, while Australian telecoms company Optus is including Amazon Music in its own subscription hub. We see this type of bundled approach as the future of music streaming. It provides a better experience for streamers themselves, new audiences for music apps, and a new revenue stream for mobile providers.

“With the music industry under pressure and subscribers pushing back against recent price hikes, Super Bundling provides an opportunity for growth that subscription services will find hard to ignore.”

For more information on the Super Bundling revolution and its impact on the US subscription landscape, download our report — Subscription Wars: Super Bundling Awakens

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.