Top trends that are expanding the Latin America mobile commerce market

by Sukey Miller

The Latin America region is a focus for online and mobile commerce businesses including major app stores and content providers. It is home to some of the fastest-growing smartphone markets worldwide, with smartphone users expected to reach 277 million by 2019. Moreover, it is set to be at the forefront of m-commerce growth globally with Colombia in first and Argentina in fifth position worldwide according to Worldpay research.

Bango looks at the top market trends that have led to the rapid market expansion across the region:

1. Smartphone penetration

Smartphone penetration in Latin America has in recent years transcended beyond just the banked segment of the population. Adoption is rising in the unbanked population as the cost of devices falls and availability increases. According to GSMA, by 2020 the smartphone adoption rate is forecast to increase to 71%.

- Nearly all banked Latin Americans use smartphones: By 2019, 223 million banked Latin Americans are forecast to have a smartphone. With payment methods including credit card available, the banked population are the perfect target audience for m-commerce growth

- Rapid growth in unbanked smartphone users: In 2015, 39 million unbanked people had smartphones with this figure set to increase to 54 million in 2019. As alternative payment methods become available, the unbanked present the biggest growth potential for m-commerce

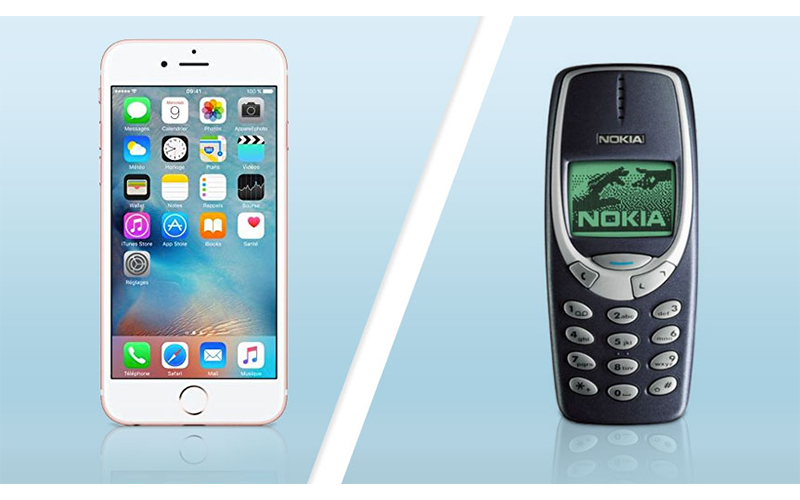

- Rise of the app stores: Increasing smartphone adoption and decreasing feature phone use is accelerating the growth of m-commerce. The emergence of app stores and value-added services has fuelled the consumption of content and services

2. Access to payment methods

The growth in the mobile commerce market in Latin America is intrinsically linked to access and availability of payment methods. Low levels of banked consumers have created a market for alternative payment methods such as stored value wallets and Direct Carrier Billing (DCB) for millions of unbanked consumers.

- High unbanked population: On average 70% of Latin Americans don’t have bank accounts. These people seek access to m-commerce but don’t have sufficient payment methods to do so, therefore alternative payment methods are essential for m-commerce growth

- Limited access to traditional payment methods: Credit card penetration varies from 32% in Brazil to 12% in Peru. With limited credit card coverage, payment providers are perfectly placed to offer alternate methods of payment like DCB or stored value wallets

- DCB growth: In Latin America, the value of digital content transactions paid for using carrier billing is expected to reach almost $800m by 2020, more than eight-times 2016’s figure of $90 million (Juniper, Digital Content Business Models: OTT & Operator Strategies 2016-2021)

3. Content types

Smartphones offer a richer experience far beyond the capability of feature phones, opening the world of social entertainment and digital media such as movies and music. Juniper data indicates revenue from content purchased on a feature phone is dwarfed by that of smartphones across content types.

- Gaming: According to data from Juniper, games will account for the largest share of all digital content sales in Latin America by 2021 with around $600m in revenue. Video and lifestyle revenues come in second with each around $200m forecasted for both by 2021

- Video and music: In Argentina, fourth largest market in Latin America, online video & music accounts for 14% of total spend on entertainment and media across LATAM (Jana Data & Insights Lead)

- DCB: Massive app store reach and distribution power has led to the average carrier billing transaction on smartphones being 400% higher than on feature phones (Juniper)

- Android apps: Brazil and Mexico are two of Google Play’s fastest growing markets worldwide for Android app downloads (Latin Post 2016)

4. Network connections

According to Worldpay research, m-commerce penetration is set to rise from 37% in 2017 to 47% in 2021, driven by increased smartphone ownership and faster network speeds. Connectivity across Latin America continues to grow supporting m-commerce growth.

- 4G adoption: Operators continue to heavily invest in 4G networks across Latin America with the average adoption rates forecast to reach 42% by 2020 (GSMA)

- Arrival of 5G: Latin American countries are set to launch 5G in the early 2020s. Argentina will see the fastest deployment of new technology with 15 million connections on 5G by 2025 (over 20% adoption), followed by Mexico with over 17 million connections (nearly 15%)

- Mobile internet subscribers: With nearly 350 million mobile internet subscribers currently and 420 million by 2020, the Latin American Market is larger than the US and in 2020, will rival the EU in size

- Argentina leading the way: Argentina’s internet penetration rate is over 80% and has the largest proportion of mobile internet users across the Latam region

Latin America is poised for huge m-commerce growth with its increasing smartphone penetration, desire among users to consume content and the growth of faster network connections. Demand is evident, but m-commerce will only successfully grow with the introduction of alternative payment methods to cater for the massive unbanked population.

Mobile operators are in a perfect position to monetize this market by delivering DCB and stored value wallets. With the help of Bango, operators including Entel in Chile and AT&T in Mexico have opened up carrier billing in Google Play, paving the way for m-commerce growth in Latin America.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.