Banking in the subscription economy – how Super Bundling can lead to customer switching and retention

by Giles Tongue | 25 Mar 2025

In the recent Subscriptions Assemble survey of 5,000 US subscribers by Bango, a staggering opportunity for banking is unveiled.

Growth of the subscription economy

The subscription economy is growing exponentially, with an estimated size of $593B in 2024, projected to reach to $1TR by the year 2028 (Juniper 2024). Everything is becoming subscriptionized. From the popular Subscription Video on Demand (SVOD) such as Netflix and Disney+ to the more unusual assemble-your-own-meal delivery food boxes and of course subscription toilet roll – pretty much everything is available as a recurring payment.

Rise of the bundle economy

The average American subscriber now has 5.4 subscriptions and spends $900 a year on their subs.

In the early days of the subscription economy, subscribers would access their favorite subscription directly from the provider – for example sign up to Netflix directly from the website Netflix.com, in what is know as a direct to consumer transaction. However this is giving way to the indirect subscriptions.

Of the 5.4 subscriptions 2 are now from indirect channels. In fact, 68% of the subscribers survey now have at least 1 subscription they’ve bought indirectly. The growth of indirect channel, and specifically due to bundling, is leading to big changes in subscriber behavior. When asked why subscribers signed up indirectly, the top two answers accurately describe some of the benefits of bundling: “it was included free with another service” and “it was easier to add to an existing bill than set up directly”.

But with this huge growth in subscription consumption, subscription fatigue has also risen.

Subscription fatigue

Keeping on top of subscriptions is becoming a challenge. In the Subscriptions Assemble report 39% find it hard to track where and how they signed up for their subscriptions, 32% don’t know how much they’re spending on subscriptions, 29% pay for subscriptions they never use and 62% can’t afford all the subscription services they would like.

New trend – Super Bundling

This has given rise to a new subscriber led trend of Super Bundling. 63% of subscribers want to be able to pay for and manage all their subscriptions, and 62% want to be able to pick and choose the subscriptions they want rather than a pre-packaged bundle.

We are starting to see the creation of content hubs, in the case of Verizon +play there are over 45 different types of content from different genres to choose from, Optus SubHub has over 20.

Paradoxically perhaps, subscribers tell us that when such a content hub becomes available, 44% would sign up to more subscriptions and 47% would spend more time using their subscriptions.

Banking and the Super Bundling opportunity

When we come out of the report and double click on the data for banking, we see something very interesting. 29% of the 5,000 subscribers surveyed, said that they would “leave their current bank / financial provider if offered a better subscription bundle elsewhere”.

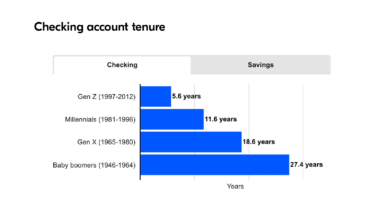

Americans with a checking account have held onto that account for an average of 19 years, while those with a savings account have had it for 17 years, according to Bankrate’s latest Checking Account Survey. The chart below showed some generations keeping their account on average 27.4 years!

Super Bundling clearly presents a huge opportunity for switching and acquiring new customers for banks and financial providers.

Banking app customers love subscriptions

Another interesting finding from digging through the data – we asked in the research “do you pay for any subscription-based services in the following categories?” One option: Financial or budgeting (RocketMoney, Plum, Monzo Premium, Revolut Ultra etc).

When we look only at those subscribers, we find that subscribers who have a financial or budgeting app, are the most prolific subscribers both in terms of number of subscriptions at 8.2 (+52% versus average 5.4), and have an average spend of $111.70 (+49% versus average $75).

Banking – top reasons for Super Bundling

When considering Super Bundling, banks are doing so to achieve core objectives, among which are:

- Attract new customers

- Create new revenue streams

- Differentiate offer versus alternatives

If you want to unlock new revenue streams, read the Subscriptions Assemble report available here, and request a call with the Bango team here to see how we can help get your subscription bundling business to market quickly.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.