Build vs Buy

Why the smart choice for subscription bundling is the Digital Vending Machine®

Bundling has evolved from a short-term promotion tactic into a core growth strategy for telecom operators, retailers, banks, and other service providers. It is now one of the most effective ways to acquire customers, improve retention, and increase subscriber lifetime value.

The model is straightforward: combine a primary service with one or more third-party subscriptions to create a package that offers more perceived value. A mobile plan that includes streaming, music, gaming, or cloud storage is more attractive than a standalone tariff. Customers get more for their money, and service providers gain a competitive edge in crowded markets.

Research from 2025 Bundling: the next wave of subscriptions found that 73% of consumers are more likely to choose a provider that offers subscription bundles. This preference is strongest among younger demographics, who actively look for deals that consolidate multiple services under one provider.

Rising subscription costs are making consumers more selective. Nearly 1 in 3 (28%) subscribers say they get a worse deal when subscribing directly, rising to 41% for those under 35, and 62% of US subscribers prefer bundles over multiple individual subscriptions (Subscriptions Assemble report, Bango 2025). Bundles manage spend by combining services into a single bill and relationship, building loyalty to the bundling provider over individual content brands.

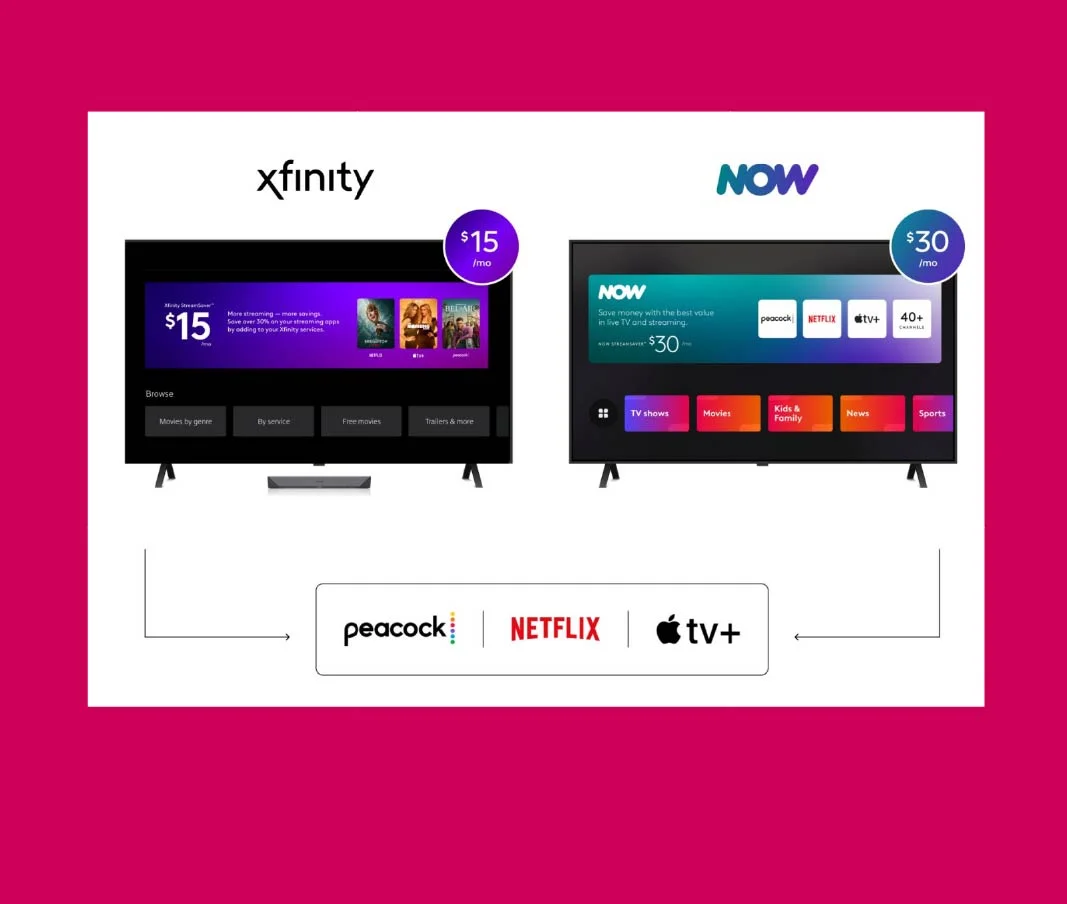

For companies exploring subscription bundling, the choice between building in-house or adopting a proven product such as the Digital Vending Machine® (DVM™) from Bango is as much a go-to-market decision as it is a technology one. It shapes how quickly you can launch, how easily you can scale, and how sustainable the operation will be over time. Real-world examples, such as Verizon’s Netflix & HBO Max multi-service package or Xfinity’s StreamSaver bundle, show how a well-executed bundling strategy can accelerate market entry and drive customer adoption.

Many businesses begin with the idea of building their own solution. The appeal lies in perceived control, full customization, and alignment with internal systems. Teams often assume they can extend billing platforms, CRMs, BSS/OSS systems or ecommerce engines to manage third-party subscriptions. On the surface, it seems logical -these systems already handle first-party subscriptions.

In reality, third-party bundling is far more complex. Every content partner brings its own API design, commercial model, entitlement logic, and technical constraints. What starts as a manageable development project quickly becomes a network of bespoke integrations that require constant coordination, updates, and fixes. This complexity also limits the ability to expand into a broader range of subscriptions, as each new partner adds to the technical overhead.

Control vs faster time to market

Building internally gives you control, but control only works if it is matched with the capacity to keep up with constant change. Each new partner requires a dedicated build and test process. Bango data shows that onboarding a single partner this way typically takes 6-12 months, but can take up to 18 months, depending on factors such as system maturity, offer complexity, partner responsiveness, and available internal resources.

Multiply that by adding more partners and the timelines quickly overwhelm engineering capacity and derail roadmaps. Development teams spend more time managing integrations than improving customer experience or delivering innovation.

No two partners operate the same way. API formats differ, authentication flows vary, use-cases needed to support one partner may not apply to others and entitlement models rarely align. A bundling platform must accommodate:

- Multiple API patterns, data models and authentication methods

- Asynchronous entitlement updates and error handling

- Mid-cycle changes such as upgrades, cancellations, phase changes or pauses

- Cross-partner orchestration without breaking customer journeys

Industry benchmarks show that engineering teams often spend over 40 percent of their time on maintenance (DevPro Journal, 2023). Each small update – partner API changes, entitlement tweaks or billing corrections – pulls developers away from innovation and slows delivery across the board.

The hidden cost of “one-off” builds

Once a partner is live, the work is far from over.

- APIs are frequently updated, entitlement rules adjusted, and new integration endpoints get added – all of which are outside the reseller’s control but require rapid updates to avoid service disruption and loss of revenue. They evolve as partners add new capabilities, refine business models, or respond to regulatory changes

- New endpoints may be introduced to support emerging features, while existing ones are deprecated, updated, or require additional parameters

- Commercial changes, such as revised pricing tiers or altered entitlement windows, often trigger urgent technical updates

- In many cases, partners also introduce bespoke flows to differentiate their customer experience, further increasing variation

Subscription bundling amplifies this. Even small changes by a content partner, such as updates to offer catalogs, trial lengths, eligibility rules, entitlement formats or cancellation policies, cascade across activation, swap, pause and renewal flows. Each change requires end to end regression testing across identity, payments, tax and billing alignment.

Without a platform built to abstract and absorb partner complexity, operators face growing delays and cost overruns. The opportunity cost is huge.

Lifecycle functionality is rarely complete

Initial builds often focus on activation and billing, but the real challenge lies in managing the full subscription lifecycle. Bespoke systems rarely cope well with:

- Trials and renewals

- Upgrades and downgrades

- Expiry and reactivation

- Entitlement recovery after a failed authentication

- Customer notifications at key lifecycle events

- Multiparty bundles with flexible entitlements

- Live error handling

- Complex eligibility rules by customer, device, or geography

- Partner-specific billing alignment and failover recovery

- Customer support for account recovery / account unlinking

Without these capabilities, offers become rigid, operational risk increases, and the customer experience suffers. Refunds and entitlement conflicts often require manual intervention, increasing cost and slowing resolution. Research shows that automating lifecycle handling meaningfully reduces involuntary churn in subscription services. Involuntary churn makes up 20–40% of total churn, and recovery programs can save 72% of at-risk subscribers and extend median lifetime by 141 days (2024 State of Subscription, Recurly 2024).

Engineering capacity limits commercial agility

When engineering must code and test every bundle change, eligibility update, or partner swap, the result is:

- Longer lead times for new offers

- Missed campaign or seasonal deadlines

- Difficulty meeting partner SLA requirements

- Limited ability to test and optimize offers

Marketing creativity is constrained by these bottlenecks, making it harder to evolve offers in line with customer demand. This speed difference often determines whether seasonal campaigns or competitive offers launch in time. Engineering time also gets diverted from the company’s core product innovation.

Multiparty bundles multiply the challenge

Coordinating multiple partners in one bundle adds another operational layer. Pricing, entitlements, upgrades, swaps, and customer journeys must all be synchronized. Even a minor API change from one partner can trigger downstream adjustments across the bundle, creating risk and delays. Industry benchmarks note that eliminating manual steps in partner management reduces onboarding time, and marketplace platforms automate onboarding and change handling – whereas manual reconciliation can drag for days or weeks. (Omdia, 2024; SolveXia, 2025).

Data insights and best practices

A product that’s part of an ecosystem aggregates and normalizes data across partners, markets, and offers, then layers proven playbooks on top. You get one view of takeup, churn, and funnel drop-offs, plus peer benchmarks and alerts when performance drifts. That lets teams choose the next offer and fix issues quickly. A solo build sees only its own logs and scattered partner dashboards. There is no common baseline, no ecosystem benchmarks, and no shared learnings from others.

The total cost is higher than expected

Over a multiple years, total cost of ownership for internal builds often dwarfs the initial project budget. Gartner has found organizations can spend up to four times the initial software licence cost to own, operate and manage applications, with technical debt and operational complexity eroding growth potential.

Bundling has evolved from a short-term promotion tactic into a core growth strategy for telecom operators, retailers, banks, and other service providers. It is now one of the most effective ways to acquire customers, improve retention, and increase subscriber lifetime value.

The model is straightforward: combine a primary service with one or more third-party subscriptions to create a package that offers more perceived value. A mobile plan that includes streaming, music, gaming, or cloud storage is more attractive than a standalone tariff. Customers get more for their money, and service providers gain a competitive edge in crowded markets. Research from 2025 Bundling: the next wave of subscriptions found that 73% of consumers are more likely to choose a provider that offers subscription bundles. This preference is strongest among younger demographics, who actively look for deals that consolidate multiple services under one provider.

Global resellers and content providers adopt the buy approach to reduce integration times, lower operational risk, and focus engineering resources on innovation. By using a proven, market-standard product with pre-built partner connections, they can launch faster, onboard more partners, and deliver flexible offers without the risk of heavy technical debt that comes with an in-house build.

Choosing to build in-house or buy the Digital Vending Machine from Bango is more than a technology choice. It shapes how quickly you launch, how easily you scale, and how much resource you spend on ongoing operations.

The table below highlights the key considerations, based on Bango experience delivering subscription bundling for global resellers

Area | Build: In-house | Buy: DVM |

Partner integration | Onboarding each new partner can take up to 18 months, depending on API maturity and resourcing, each with custom requirements (Omdia Subscription Partnerships Survey, 2024). | Connect once to access pre-configured partner integrations. New offers can be launched in weeks. |

Lifecycle management | Requires custom coding for upgrades, downgrades, renewals, and re-authentication. This increases the chance of errors and slows delivery. | Built-in lifecycle management covers all key subscription events. Reliability and retries are maintained without extra development work. |

Speed to market | Development and testing cycles delay new offers. Many projects miss seasonal or partner-driven launch windows (Omdia OTT Marketing Trends, 2024). | Commercial teams can configure and launch offers without waiting for developer cycles. Campaigns can go live in days. |

Multiparty bundles | Coordinating pricing, entitlements, and billing across multiple partners is highly complex. Mid-cycle changes -like price updates, product swaps, or upgrades – trigger cascading updates across multiple BSS/OSS systems and delay time to market. | Multiparty bundles are managed centrally. All services in the bundle stay aligned on pricing, entitlements, and customer journey. |

Data and insight | Data is often spread across separate dashboards. Teams spend up to 30% of their time compiling reports. | A single analytics dashboard provides realtime performance data and benchmarking across the whole ecosystem. |

Maintenance load | Ongoing API updates and partner changes consume 35–50% of engineering capacity (Omdia Telco Network Automation Survey Report – 2024). | Partner updates and API changes are managed within the DVM, freeing internal teams to focus on growth. |

Scalability | Scaling from 5 to 15 partners can triple operational workload (Omdia Digital Services Forecast, 2024). | The DVM scales without increasing internal workload, enabling growth across partners and markets. |

This breakdown shows the difference clearly: building in-house means managing complexity for the lifetime of the solution. Adopting the DVM means using a proven product that handles the complexity for you, freeing internal teams to focus on growth and customer experience.

With the Digital Vending Machine, operators have delivered complex multiparty bundles in under 12 weeks per partner – compared to the industry average of up to 20 months for bespoke builds.

Subscription bundling succeeds when every participant in the ecosystem benefits – the operator or reseller, the content and service providers, and ultimately, the consumer. The Digital Vending Machine from Bango is designed to deliver value to all three.

For resellers

- Faster time-to-market: One-time connections, with many of the top brands pre-connected and ready to go, along with standardized end-to-end use cases, means new offers, even advanced multiparty offers can be launched in days not months

- Lower operational burden: Ongoing partner management, entitlement logic, and API updates are handled by Bango, reducing demand on engineering teams

- Greater commercial agility: Marketing and product teams can configure, test, and update offers without waiting for code releases

- Scalable growth: Supports unlimited partners and bundles, including complex multiparty offers, without adding technical debt

- Ecosystem insight: Proven solutions often include unified analytics, enabling resellers to benchmark performance and detect headroom for growth in real time. They can also surface offer and partner recommendations based on trends and proven results across the wider ecosystem

For content and service providers

- Broader distribution: Instant access to the Bango network of connected operators and resellers worldwide

- Consistent delivery: Uniform activation, entitlement, and billing processes across multiple partners and markets

- Reduced integration overhead: Connect once to Bango and reach many partners, avoiding the need for multiple bespoke integrations

- Better customer insights: Connect once to Bango and reach many partners, avoiding the need for multiple bespoke integrations

For consumers

- Simpler activation: One click to activate services within a trusted account environment

- Aligned billing: All subscriptions appear in a single bill, avoiding duplicate charges or missed renewals

- More choice and flexibility: Wide range of offers, including the ability to mix and swap services within a bundle

- Personalized recommendations: Offers matched to preferences, devices, and usage patterns, enhancing relevance and satisfaction

By connecting all sides of the subscription economy through a single product, the Digital Vending Machine from Bango enables operators to grow revenue, content providers to expand reach, and consumers to enjoy frictionless access to the services they value.

Leading operators and marketplaces are already using the Digital Vending Machine from Bango to accelerate launch times, onboard more partners, and scale subscription bundling without creating an internal engineering burden. Their results highlight why buying is often the smarter, more strategic choice.

Tier 1 North American telco

Scaling multiparty bundles

A major North American telco wanted to launch bundles combining multiple streaming and gaming services. The goal was to create flexible offers that could be updated in response to market trends without major development work.

With the DVM, they:

- Delivered complex multiparty bundles in under 12 weeks per partner, compared to the industry average of up to 20 months for bespoke builds

- Aligned billing, entitlement, and lifecycle rules across all services, avoiding double billing and activation errors

- Enabled marketing teams to create and adjust offers independently, freeing engineering resources for other priorities

If built internally, the telco estimated:

- More than $2M in development and maintenance costs over the first three years

- A multi-year delay before reaching the same breadth of offers and partner coverage

- Limited ability to adapt offers quickly, reducing competitiveness

Tier 1 Australian telco

Rapid partner onboarding

A leading Australian operator wanted the ability to launch new content partners quickly, without tying up technical resources.

With the DVM, they:

- Launched multiple new subscription partners in under six weeks each

- Connected once to Bango and gained access to a ready-made ecosystem of pre-integrated partners

- Introduced eligibility-based offers, targeting customers by device, geography, and account history

A built-from-scratch approach would require:

- Separate integrations for each partner, consuming months of engineering time

- Ongoing maintenance for every API change or entitlement rule update

- A slower commercial cycle, missing opportunities to capitalize on trending content

Within the DVM CX, once signed in, this button changes to “Start setup”, it triggers the consumer offer API request. After sending that request in, DVM’s offer orchestration takes that request and makes everything happen, including the create entitlement call needed and the communication to the content provider.

Global SVOD marketplace

Consistent delivery across global markets

A global subscription video marketplace needed to manage entitlements and billing across multiple countries, partners, and currencies. Consistency and reliability were critical to protect the brand and retain customers.

With the DVM, they:

- Delivered identical onboarding and billing experiences in dozens of markets

- Reduced partner integration time from months to weeks

- Leveraged shared lifecycle logic, ensuring upgrades, downgrades, and cancellations worked the same way everywhere

A proprietary solution would have required a dedicated global engineering team to:

- Build and maintain individual market integrations

- Handle localization, currency, and partner requirements for each country

- Invest heavily in operational monitoring to avoid service interruptions

Across all three cases, the Digital Vending Machine from Bango cut time to launch from many months to just weeks, avoiding millions in projected engineering spend. In one instance, Bango connected and launched a Portuguese retailer with Disney+ in just 8 weeks from start of conversations. By removing the need for bespoke development for each partner, commercial teams gained the freedom to test, launch, and adapt offers directly, without waiting for developer resource.

This is not just a technical decision. It is a strategic one.

The decision to build internally or adopt a proven product like the Digital Vending Machine from Bango will define the success of your subscription bundling strategy. Building may appear logical at first, especially for teams with strong in-house engineering capability, but the reality changes as scale, complexity, and partner diversity increase.

Each new service adds its own integration demands, lifecycle rules, and commercial terms. Managing these individually consumes time, budget, and engineering focus. The impact is felt across the business: slower partner launches, limited marketing agility and a growing backlog of technical maintenance.

Buying the Digital Vending Machine removes these barriers. It is already integrated with leading global content and service providers, comes with prebuilt logic to support multiparty bundles, and gives commercial teams the tools to create and adapt offers without waiting on development cycles. It also benefits from the Bango ecosystem effect, enabling access to shared benchmarks and ecosystem-wide insights that no siloed in-house solution can replicate. These insights not only inform better offer design but also drive measurable improvements in adoption, conversion, and retention.

For customers aiming to scale quickly, support diverse bundles, and maintain agility in a competitive market, adopting the Digital Vending Machine is a strategic investment.