Must have and nice to haves – the subscriptions Brits can’t live without

by Giles Tongue | 19 Nov 2024

Bango has been uncovering subscription trends around the world with panel surveys gathering data insights from 27,500 people in 25 countries across the USA, LATAM, Europe, Far East and Southeast Asia and India.

Subscription fatigue appears to be taking hold globally, with Bango research revealing consistent trends across all markets:

- Subscribers find it hard to keep track of where and how they signed up for a subscription

- They don’t know how much they’re spending on subscriptions

- They pay for subscriptions they never use (we call these ‘Vampire Subscriptions’)

- Many can’t afford all the subscriptions they would like

Driving this subscription fatigue is the significant growth in the number and variety of products sold through subscription models. This has been enabled in part by the simplification of payment methods for subscriptions (a recurring payment) such as payment through mobile providers which account for 20% of all subscription video on demand distribution (Omdia).

Another major trend, has been the growth of what we first called the ‘Forever Subscription’ – those subscriptions that the subscriber says they will never pause or cancel. This is something that has come up in all our surveys around the world. Here we’ve followed up on this question, asking 1,300 UK subscribers, about their Forever Subscription.

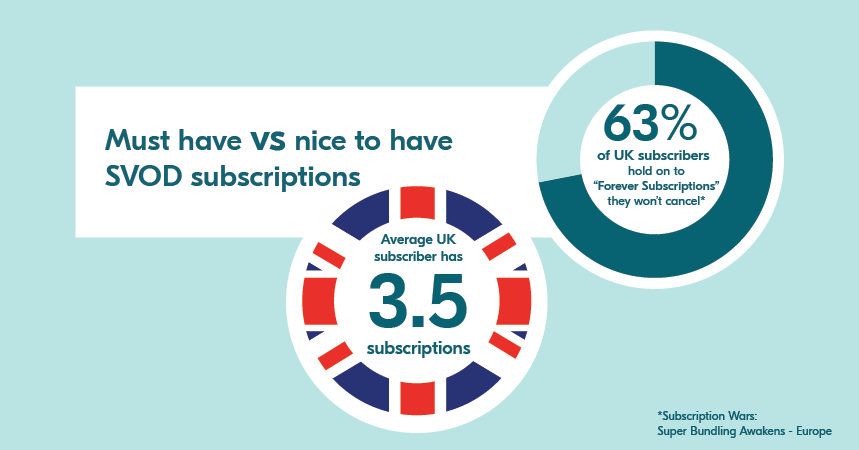

First, let’s review the data from our recent Subscription Wars: Super Bundling Awakens – Europe study. The most popular subscription type in the UK is subscription video on demand (SVOD). The average annual subscription spend in the UK has reached £696 ($886) per year, closely approaching the average US spend of $924 per year which remains the highest spending region in the markets we’ve studied so far.

However, 1 in 8 Brits spend over £100 ($127) per month, the equivalent data from our US study was 1 in 10 spend over $100. This means British subscribers appear to be spending more per subscription than US subscribers, given that the average number of subs in the UK overall is lower at 3.5 vs 4.5 in the US.

In our new data, released today, we uncover which are the subscriptions UK subscribers consider their Forever Subscriptions.

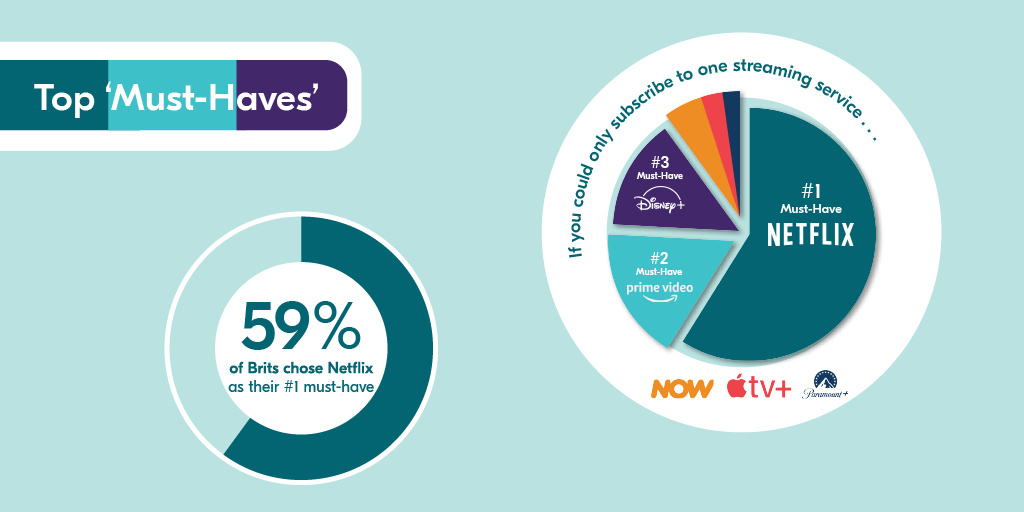

We asked: “If you could only have one subscription video on demand service (SVOD), what would it be?”

Provided a list of the most popular SVODs available in the UK, the answers are quite stark.

Almost two thirds of the 1,300 surveyed choose Netflix, in a perhaps surprisingly unequivocal outcome. In a distant second place it’s Amazon Prime Video followed by Disney+.

So, Netflix, and somewhat Amazon Prime Video and Disney+ are the ‘must-have’ subscriptions for UK subscribers.

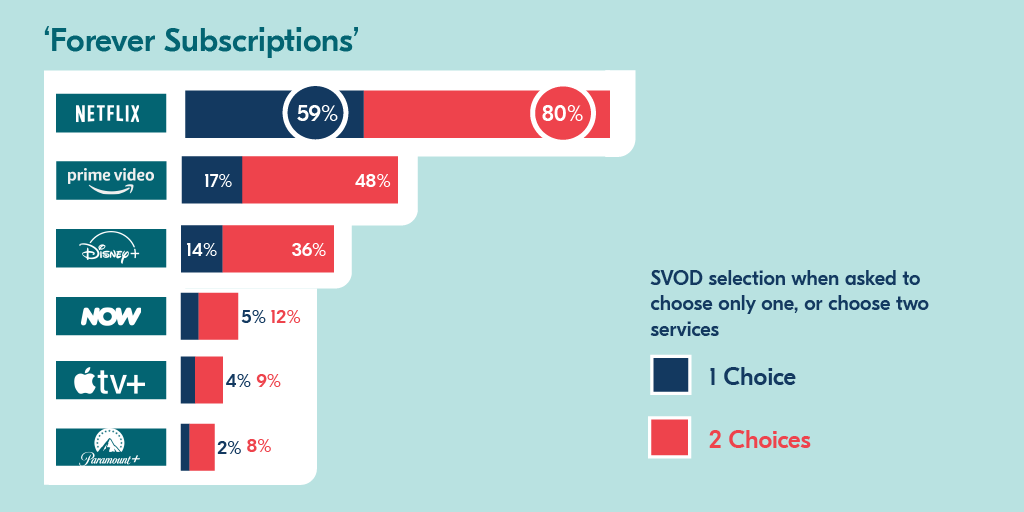

This intriguing distribution of responses provokes a fairly obvious question – if given a choice of two Forever Subscriptions, do those outside of Netflix leap up to become must have or are they still nice to have? Do some of the rest of the pack jump up the preference order or are first and second place made up of only those three subscriptions?

So, we asked: “If you could have two subscription video on demand service (SVOD) services, which would they be?”

If this was a subscription race, the commentator might be saying that Netflix, Amazon Prime Video and Disney+ have extended their lead – the rest of the back, while growing in preference, are still some way behind.

The three “must haves” have extended their position – among UK subscribers:

- 3 out of 4 subscribers would take Netflix

- Half Amazon Prime Video

- A third Disney+

And unexpectedly perhaps, NOW – which includes Sky (Comcast) content – comes ahead of AppleTV+ and Paramount+, potentially because it incorporates a lot of UK sports coverage.

Look out for more subscriber insights from Bango. In the meantime, explore all Bango reports here, where you can download our content for free.

* Notes on survey – Hulu content is part of Disney+ in the UK; Hulu, HBO’s Max, Peacock and YouTube TV are not available in the UK. YouTube while primarily AVOD, is available as SVOD YouTube Premium, but excluded as an option from this survey. A panel of 2,000 UK citizens were surveyed by a third party for Bango, non-subscribers were removed from answers, leaving 1,300 respondents.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.