Two thirds of music streamers can no longer afford their subscriptions

by Giles Tongue

Latest price increases drive subscriber demand for cross-platform bundles and deals

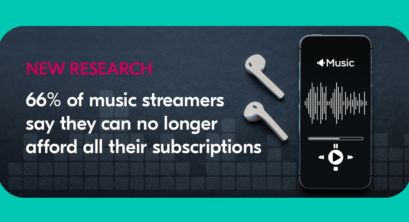

Faced with rising prices and more subscriptions to choose from, two-thirds of music streamers (66%) say they can no longer afford all of their subscriptions. That’s according to newly released research from Bango, which surveyed over 2,000 music streaming service users in the USA.

The news comes following multiple price increases across music platforms last year, with major players announcing further price hikes in the coming months. As a result, many subscribers must pick and choose between streaming TV, music, gaming and other subscriptions, with 60% having canceled at least one subscription to afford the rising prices.

More than a third (39%) have also downgraded at least one of their subscriptions to a cheaper, ad-funded tier to save on costs.

Despite this, Bango argues that streaming services won’t need to lower prices to retain, and even grow, their customer bases. According to the company’s analysis — published in a new blog post — the streaming market continues to boom, with Bango warning that streaming platforms shouldn’t enter “a race to the bottom” by lowering prices.

Instead, Bango’s data suggests that music platforms will be better served by joining with other subscription services via Super Bundling — providing users with greater flexibility, easier access to deals, and more centralized billing.

The data supports this idea, with 80% of music subscribers saying they want their music streaming services to be combined with other subscriptions in a single platform. More than half (54%) would also like to use Super Bundling as a way to secure cross-platform discounts, while over three quarters (77%) believe this type of all-in-one platform could ultimately help them manage their expenses and deal with rising costs.

Discussing the potential of this move, Anil Malhotra, CMO of Bango says “Music streaming holds a unique position in the subscription landscape. Unlike other subscriptions, the content across different music streaming services is largely consistent across all platforms — making it a challenge for providers to differentiate their services. In the case of market leader Spotify – who recently reported a 14% rise in paid subscribers in Q1 of 2024 – this has meant a major expansion into audiobooks and podcasts. This differentiation challenge, coupled with rising prices, means that music streaming platforms may have to work even harder to reach new audiences.”

“That’s where Super Bundling is so essential. Bundling multiple services opens a whole new field of potential users, while bringing added value to subscribers. Music and movies, music and fitness, music and gaming — any number of different combinations can work. With the music industry under pressure, and users clearly struggling with continued price hikes, Super Bundling provides a new opportunity for growth and retention, without cutting prices.”

When it comes to who should offer this type of Super Bundling package, Bango’s data also provides an answer: 60% of music streamers want their cell phone provider to lead the charge. More than half of those surveyed (58%) also say that they would be willing to pay a higher monthly bill if this type of all-in-one subscription service was provided.

As Anil explains, “Super Bundling not only represents an opportunity for music streaming platforms, but also for mobile and internet providers. Already Verizon is offering the live music service VEEPS as part of its +play platform, while Australian telecoms company Optus is including Amazon Music in its own subscription hub. We see this type of bundled approach as the future of music streaming. It provides a better experience for streamers themselves, new audiences for music apps, and a new revenue stream for mobile providers.”

To find out more US music subscriber trends, read Bango’s full data here.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.