Subscription Wars: Super Bundling Awakens – Latin America

The LATAM subscription market is estimated to be worth USD$20 billion, a figure that’s projected to almost double by 2026.

This surge is fuelled by a predominantly mobile-first consumer base that prioritizes convenience and instant access to services. As these consumers increasingly turn to subscription models for everything from streaming entertainment to retail services, lucrative opportunities are opening up for both subscription platforms and any business that canprovide access to these services.

As the latest in our international ‘Subscription Wars’ series, this report highlights unique demands, trends and challenges facing the LATAM subscriptions market. Calling on data from 6,400 subscribers across six Latin American countries, we dive into all aspects of the subscription economy, from changing adoption rates to ad-tiering, post-paid billing, to the rise of Super Bundling.

Methodology

This report includes data from 6,400 subscribers across Mexico, Brazil, Peru, Colombia, Chile, and Argentina, diving into diverse aspects of their experience with subscription services.

Commissioned by Bango and conducted by independent research agency 3Gem, the Subscription Wars: Super Bundling Awakens Latin America research was conducted in April 2024 – May 2024 and published in June 2024.

In this report, you’ll discover

- The gap between pre-paid and post-paid mobile plans in LATAM and why it’s closing

- The state of subscriptions in the region

- The impact of price hikes on LATAM’s cost-sensitive subscribers

- The main sources of subscriber overload and frustration

- The rise of content hubs and the power of Super Bundling

1. Pre-paid vs post-paid: The subscriptions shift

For years, pre-paid plans have ruled the mobile market throughout LATAM. Traditionally, pre-paid options gave customers greater flexibility, while providing a safety net during turbulent economic times.

Of course, pre-paid customers also present challenges. Without long-term contracts and fixed monthly fees, the opportunity for subscriptions and bundled deals has remained limited.

Today, that’s all changing. Post-paid options are muscling their way into the market, with a third of respondents (30%) now on a post-paid plan.

At the same time, as more consumer services adopt a subscription model, pre-paid customers have become accustomed to subscribing to services. As competition in the market heats up, telcos are also encouraging customers to switch to recurring bills through incentives such as data bonuses and discounts — further closing the gap between pre-paid and post-paid.

In this new landscape, pre-paid customers increasingly act like their post-paid counterparts. Over half of those on a pre-paid plan (55%) now repeatedly top up with the same amount, at the same time, every month. Both groups also pay for a similar number of subscriptions, billed in a similar way, over a similar length of time.

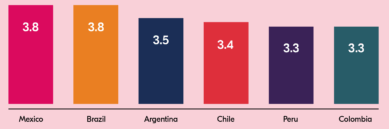

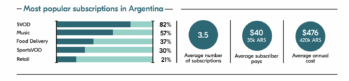

As the gap between pre-paid and post-paid closes, the market for subscriptions grows. Already, LATAM subscribers pay for an average of 3.5 subscriptions per person, rising to 3.8 in the largest markets of Mexico and Brazil — catching up with the USA’s 4.5.

2. The state of subscriptions

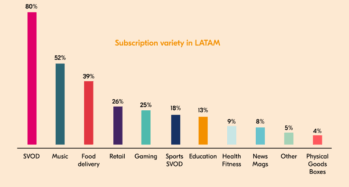

Subscribers across LATAM enjoy a variety of subscriptions spanning different content types – and are keen to adopt more. But it’s Subscription Video on Demand (SVOD) which anchors the demand, with Latin America predicted to have 165 million SVOD subscriptions by 2029 – a 50% increase from 110 million at the end of 2023.

And given that telco-bundled SVOD subscriptions made up one-third of the LATAM and Caribbean market in 2023 with this number set to rise to 50% by 2028, it’s telcos who could reap the biggest rewards.

However, if content providers are going to take advantage, they need new ways to reach subscribers. Content quality and direct sign-ups are no longer enough.

Sports drives subscriptions

SportsVOD provides a growing opportunity in LATAM with telcos set to be among the biggest beneficiaries

1 in 5 LATAM subscribers have a SportsVOD subscription

Nearly 1 in 3 LATAM subscribers (30%) will sign up for a new service to watch Copa América

LATAM leads the way in music

Music subscriptions are especially popular in LATAM when compared with other regions

Over half of LATAM subscribers (52%) have a music subscription

Compared with 44% in the USA and only a third (34%) in Europe

3. Market trends: Mobiles and monetization

The LATAM market was the first to experience significant price hikes for subscriptions and streaming services – worsened by high inflation in recent years. This surge has hit subscribers hard, with 40% now having to pay fora service they used to access for free, and 37% frequently pausing and restarting their subscriptions.

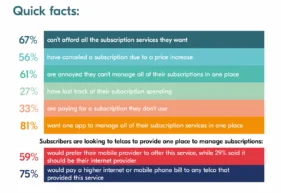

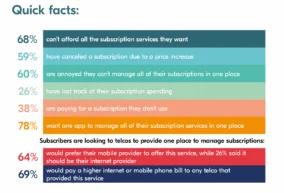

Faced with rising fees, more than two-thirds of subscribers (68%) say they can’t afford all the subscriptions they would like, rising to 73% in Brazil. More than half (56%) have had to cancel a subscription due to the price hikes, rising to 63% in Argentina.

$37 LATAM subscribers average spend

(Amounts to $444 per year)

Repeated price increases will only go so far. Sooner or later, even the most loyal subscribers will be forced to pick and choose between services. The result for providers? Increased churn, negative customer perception, and lower customer acquisition in the long term.

To mitigate this risk, subscription services are offering hybrid-pricing models to remain affordable. “Mobile tiers’’ are one strategy pioneered by LATAM companies to cater to the region’s mobile-first habits. Through options like ‘Paramount+ Basic’, subscribers can access mobile-only content at a more affordable rate, accommodating the 50% of subscribers who watch Paramount+ on their mobile.

Ad tiering is also helping to give people more choice and flexibility. In addition to its mobile-only subscription tier, Netflix has introduced an ad-supported plan priced 28% cheaper than its Basic plan.

When it comes to ads, however, subscription service providers should tread carefully. Almost half (44%) of LATAM subscribers have canceled a service due to the introduction of ads. While over a third (34%) have downgraded since a cheaper ad-supported tier launched, the same percentage have upgraded to avoid ads altogether.

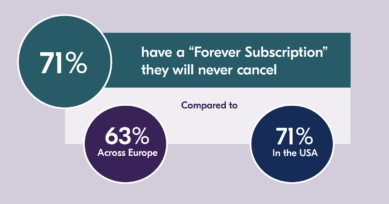

Forever Subscriptions

Despite many jumping between services, LATAM subscribers are fiercely loyal to their favorite providers. The overwhelming majority have a Forever Subscription they will never switch off.

4. Managing subscription overload

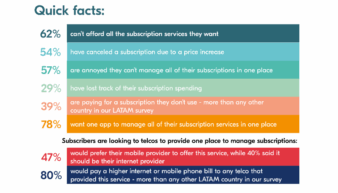

While there is growing demand for subscriptions, the disjointed and inflexible nature of the current subscription economy in LATAM could slow its progress, restricting consumer satisfaction with their subscriptions.

Subscribers feel there are now too many subscription services and are becoming increasingly overwhelmed. Rigid contracts compound their disillusionment. Then there’s the financial burden, made worse by the complexity of managing billing across multiple service providers.

Overload

80% say there are now too many subscription services to choose from (rising to 88% in Brazil)

60% say they are annoyed they can’t manage all of their subscriptions in one place

Inflexibility

37% are frustrated they can’t pause their subscriptions

whenever they like (rising to 41% in Columbia)

27% say they feel locked into their current subscriptions

Cost

27% don’t know how much they spend each month on subscriptions (reaching 34% in Argentina)

59% want to opt out of automatic renewals on their subscriptions (hitting 62% in Peru and Colombia)

Subscribers are responding by sticking to just one or two subscriptions simply to avoid the mess of managing them. Others abandon the market altogether and turn

to online piracy.

Neither scenario spells good news for the subscription economy and its future

potential.

A pirate’s life for me

1 in 5 LATAM subscribers (19%) have started using pirate streaming services as the only way to access content in one place

5. The rise of content hubs

So what are organizations doing to solve some of these challenges?

Bundling subscriptions is one answer, giving subscribers greater choice, simpler management, and more cost-effective deals. One in five (21%) LATAM subscribers now go exclusively indirect for their subscriptions, signing up via bundles and deals from third-party services. Latin American telco giant Claro offers Prime Video with Claro TV via its home and post-paid mobile bundle plans. Peru’s Movistar TV has plans that include internet with Disney+ and Star+ at no extra cost.

While bundling solves some subscriber woes, it’s not an all-out cure. Bundled packages are still subject to the same lack of flexibility when it comes to managing subscriptions. They often focus on offering the biggest names in streaming, ignoring the fact that subscribers are also signed up for gaming, well-being, and other services that also need to be managed.

Subscribers want more

In the US and Australia, full-service “content hubs” like Verizon +play and Optus SubHub have emerged, revolutionizing the subscriptions landscape – and giving subscribers more choice and control. Now, consumers are calling out for these types of all-in-one platforms to break into the LATAM market.

Over three-quarters (79%) of LATAM subscribers want one app to manage all of their subscriptions and accounts, rising to 82% in Peru. Over two-thirds (68%) would also spend more time using their subscription services if an all-in-one subscription platform were available. And more than half (58%) would sign up for more subscription services if an all-in-one subscription platform was available.

79% of LATAM subscribers want one app to manage all of their subscriptions and accounts

Better financial management is the standout benefit for LATAM subscribers thanks to one centralized bill. Four out of five (81%) subscribers feel they would better manage their household expenses if this service became available elsewhere.

Features LATAM subscribers want from all-in-one subscription platforms:

- 69% Ability to pay multiple subscriptions via one monthly bill

- 46% Ability to temporarily pause subscriptions (“Payment holidays”)

- 41% Ability to calculate the best deals and prices across all platform

- 41% Discounts on paid subscription services

- 40% Ability to centrally update payment details

- 39% Ability to change subscription duration (weekly, vs monthly vs annually)

6. Super Bundling: Telcos take control

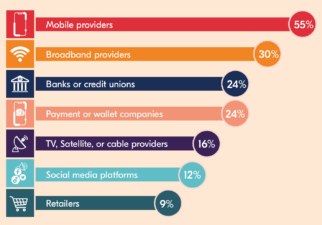

Subscribers are not only calling for content hubs; they also expect telcos to deliver these services. In a market where mobile is the dominant platform for content consumption, it’s no surprise that the majority (55%) of subscribers want mobile providers to spearhead the creation of centralized content hubs.

This telco focus surpasses the USA (50%) and Europe (46%). Outside of telcos, 1 in 4 would ask banks and payment companies to step up and provide this service as well.

Who do LATAM subscribers want to provide an all-in-one subscription service?

Subscribers are willing to pay for the privilege. Over half (56%) would pay a higher bill if a package of popular subscriptions were automatically included. In Mexico, this number was 62%. When asked how much higher, the average subscriber said they were open to paying 21% more on their mobile bill if subscriptions were included in the price.

Stronger brand loyalty would be included in the bargain, with almost three-quarters saying they would be more loyal to a brand that offered an all-in-one subscription service. On the flip side of this coin, over half would leave their current provider if this service became available elsewhere.

Increased customer spend and loyalty

Of LATAM subscribers would be more likely to recommend a provider that offers this service – rising to 81% in Colombia

Would be more loyal to a brand that offered an all-in-one subscription service

Would pay a higher bill if a package of popular subscriptions was automatically included – rising to 62% in Mexico

Would leave their current provider if this service became available elsewhere

The streaming platforms Max, Disney+, Amazon Prime Video, Netflix, Vix+, and Paramount+ have all already established various strategic alliances with telecommunications, financial, and commercial companies in LATAM, to attract and retain subscribers. While bundling of subscriptions within telcos is already an advanced market in the region, few telcos are offering subscriptions outside of SVOD – for now.

Super Bundling will be the key technology that allows this expansion to happen.

Section 2: State of the nation

Subscription trends per country

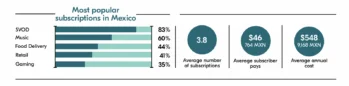

Subscriptions are rising in popularity in Mexico, driven by the increasing adoption of digital services, the expanding middle class, and changing consumer behavior. While Mexico is one of Spotify’s biggest markets, SVOD subscriptions are the most popular. Gamer culture is also spreading, driving up the popularity of gaming subscriptions in the region.

The average subscriber has 3.8 subscriptions costing 9,168 mexican pesos a year. Lack of affordability means almost two-thirds (62%) of subscribers struggle to pay for all the subscriptions they want, and over half (54%) have canceled subscriptions due to price increases.

Subscription management is a big concern for subscribers in Mexico. Over a third (39%) pay for a subscription they don’t use – more than any other country in LATAM.

The upshot? They’d be willing to pay a higher bill to any telco that provided a service where they could manage all their subscriptions in one place.

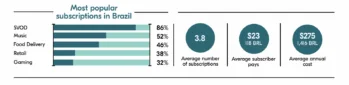

The largest connected market in Latin America and the fifth-biggest online population worldwide, Brazil presents a huge growth opportunity for subscription services. SVOD is highly popular, significantly beating music, food delivery, retail, and gaming subscriptions.

Like Mexico, subscribers in Brazil have multiple subscriptions and affordability is a concern, with nearly three-quarters (73%) saying they can’t afford all the services they’d like. Price sensitivity has seen more than half (51%) cancel a subscription following increases. A significant proportion – more than any other LATAM country – are frustrated they can’t manage all of their subscriptions in one place.

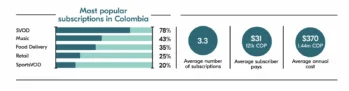

Rising demand for subscriptions in Colombia is characterized by the huge popularity of SVOD versus other types. Nevertheless, other categories such as music and food delivery are gaining ground.

Much like other countries in LATAM, high costs and complex management form the main barriers to subscriber adoption with two-thirds (67%) unable to afford all the subscriptions they want. Difficulty with keeping track of subscriptions compounds this issue, with a third (33%) paying for a subscription they don’t use and over a quarter (27%) unaware of their spending.

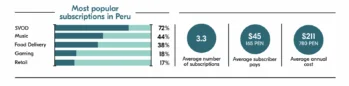

Rising internet penetration, particularly in rural areas, signals strong growth potential for the Peruvian subscriptions market. But currency fluctuations and income disparities mean affordability is a vital consideration for consumers. Over two-thirds (67%) can’t pay for all the services they want and over half (52%) have canceled a subscription due to price increases.

On average, they have slightly fewer subscriptions than their LATAM neighbours. Yet subscribers in this region are the most eager for one app to manage all of their subscription services in one place. In fact, despite financial challenges, over three-quarters (76%) would pay more to any telco that offered a centralized subscription management hub.

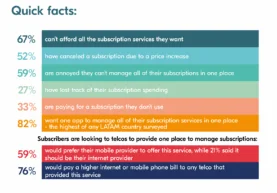

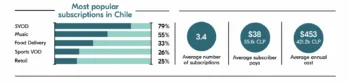

Growth in digital payment services like Webpay and MercadoPago are accelerating a cashless culture, resulting in less friction between consumers and online payment.

We see similar patterns to other countries in Latin America when it comes to difficulty keeping track of subscriptions and managing the financial implications of this, along with rising costs. More than half (59%) have canceled a subscription because of price hikes but would nonetheless pay a higher bill for a single subscription management app.

While SVOD remains the number one subscription category, Argentinians have the second highest percentage of music subscriptions in Latin America, after Mexico. They’re also the biggest sports fans, at least in terms of subscribers, with almost a third (30%) paying for a SportsVOD subscription – the most of all the LATAM countries surveyed.

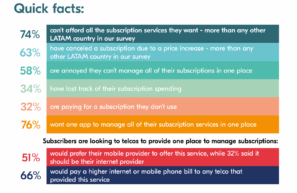

Subscribers in Argentina appear to be in the most financial difficulty in the region, with nearly three-quarters (74%) unable to afford all the subscription services, and almost two-thirds (63%) having stopped a subscription after costs went up.

While the appetite for content is there, economic barriers may impact consumers’ ability to afford subscriptions. Providers should look to flexible pricing, value-added features, and other innovative solutions as part of bundled offers to attract price-sensitive subscribers.

Super Bundling: Where do I start?

Content providers

Super Bundling gives content providers instant access to a ready-made distribution, marketing and billing network offered by telcos and other channels around the world. Bringing together telcos and content providers in one place, the Digital Vending Machine® from Bango is a SaaS product that enables the Super Bundling of content subscriptions.

Several global telcos have already created their own vibrant content hubs – bringing together dozens of providers including Netflix, ESPN, Amazon Prime, Duolingo, YouTube, Peloton, Audible and more in one seamlessly integrated solution.

The Digital Vending Machine® from Bango isn’t just for established players. The low barrier to entry means it’s ideal for content and service providers looking to make a name for themselves. Plus, it opens doors to some of the biggest reseller networks around including telcos, banks and retailers. Support for a range of commercial models means that the Digital Vending Machine® from Bango ensures you get to market at speed and with minimal integration pain.

The Digital Vending Machine® from Bango brings together resellers and content providers to enable Super Bundling of subscriptions at speed and scale.

Telcos

The Digital Vending Machine® from Bango is loaded with pre-built integrations for hundreds of subscription products, apps, and streaming services. We provide all the core requirements via standardized technology enabling telcos to deliver Super Bundling in months, rather than years.

The Digital Vending Machine® from Bango is available as a SaaS product, which means telcos can quickly and easily scale, gaining access to a constantly evolving and growing ecosystem of global subscription and content providers.

This happens through a single one-to-many integration, avoiding time-consuming one-to-one arrangements. Enabling this super-fast time to market means that telcos can focus on the things that matter most to them: customer acquisition, retention and engagement. Developing subscription hubs with Verizon and Optus, we’ve helped create deals spanning Netflix, ESPN, Amazon Prime, Duolingo, YouTube, Peloton, Audible and more.