Super Bundling: the next trend in subscription bundling

Subscription economy and the rise of the indirect channel

The subscription economy is expected to grow from today’s $722 billion to $1.2 trillion, by 2030 (Juniper, Summer of bundles)

The average subscriber now has 5.4 subscriptions, a third of which are bought through indirect channels (see our recent r esearch: Subscriptions Assemble). According to Omdia, by 2030 telco-bundling will represent 23% of all subscription video on demand (SVOD) sales, and a further 10% of SVOD sales will come from non-telco bundling. This shows that subscriptions are no longer sold exclusively direct-to-consumer and are increasingly available via telcos (mobile operators, broadband and PayTV), and other indirect channels such as banks, retail and benefit companies.

Subscription services are pivotal to our lives, with 49% of subscribers stating they are “essential” and 70% stating that they have at least one subscription service they will never cancel, a “Forever Subscription”. Average spend is now $900, with 23% of subscribers spending $100 or more a month.

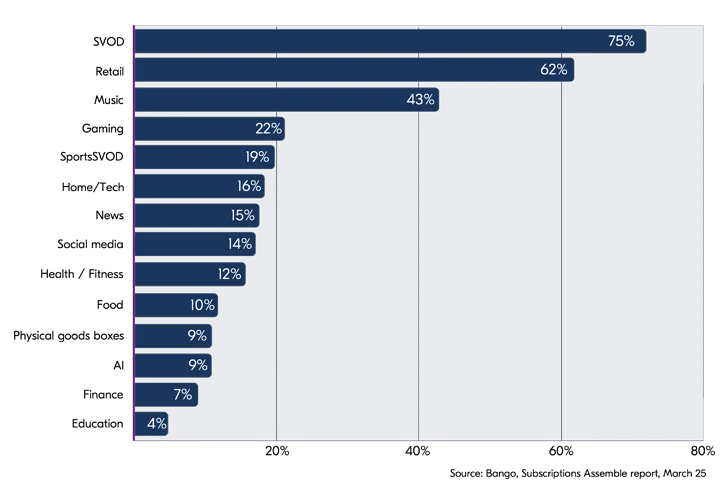

What are the most popular subscriptions

Popular subscriptions in the US are SVOD (such as Netflix, HBO Max, Disney+), Retail (e.g. Amazon Prime, Walmart+) and Music (e.g. Apple Music, Spotify).

- SVOD, Retail and Music are the most popular category in Far East Asia including Taiwan, Japan and Korea, see here for regional subscriptions report data

- SVOD, Music and Food delivery are the most popular category in Latin America including Mexico and Brazil, see here for regional subscriptions report data

- SVOD, Retail and Music are the most popular category in Europe including UK, France, Germany, Italy and Spain, see here for regional subscriptions report data

- SVOD, Music and Retail are the most popular category in South East Asia and India, see here for regional subscriptions report data

What is subscription fatigue

With this growth in volume – and types – of subscription, there is an overwhelming feeling of subscription fatigue.

39%

of subscribers find it hard to keep track of where and how they signed up for subscription

32%

don’t know how much they spend on subscriptions

29%

pay for subscriptions they don’t use (rising to 49% of 18–24-year-olds)

62%

can’t afford all the subscription services they would like

What subscribers want most – flexibility and control

Subscribers are looking for a way to manage all of their subscriptions in one place – a subscriptions hub. They are clear about what they expect from a subscriptions hub – research and industry surveys point to four core demands:

- Simplicity: 63% want one login, one account, one bill – no more juggling services separately

- Control: The freedom to pause, resume, or swap subscriptions as life changes – 62% would prefer to pick and choose rather than be given a pre-packed bundle

- Choice: 59% A wide range of content and lifestyle services beyond video, from music to meditation apps

- Value: 58% Bundled pricing, relevant offers, and curated recommendations

What is bundling?

Bundling is the practice of combining one or more services into a single offer, typically a first-party service like a mobile phone plan, with a third-party service included within the price. This is known as a hard bundle, usually included at no additional cost to the consumer.

Alternatively, a soft bundle, gives the consumer of the first-party service an element of choice about adding additional subscription services. Usually with a soft bundle the user has the choice to add, but they must pay for the service – maybe the full price or a discount.

By understanding bundling, we can better appreciate the evolution towards Super Bundling, which is being driven by consumer demand, as well as creating opportunities for content providers growth and meeting multiple and varied reseller objectives.

Subscriber-led demand for Super Bundling

Subscribers are asking for flexibility and control when it comes to subscriptions, since they are overwhelmed by subscription fatigued. Subscribers can regain control over their subscriptions through subscriptions hub which enable management and payment of multiple subscriptions in one place – known as Super Bundling.

When this is achieved a paradox is resolved – rather than wanting less subscriptions due to subscription fatigue, subscribers state they would sign up to more subscriptions (44%), spend more time using their subscriptions (47%), would be more loyal to the provider of those subscriptions (57%), would leave their current (TV, mobile, broadband) provider (46%) and would recommend the services to their friends (62%).

What is Super Bundling?

Super Bundling is the ability for a subscriber to pay for and manage all their subscriptions in one place. Traditional bundles were limited and inflexible. A telco might offer a music or video service free for six months, tied to a specific mobile plan. Once the promotion ended, customers were left to manage that subscription directly with the provider, removing any benefit to the telco of increased customer stickiness.

Super Bundling is different. It’s dynamic and flexible. Instead of rigid promotions, subscribers have a subscriptions hub where they can add, pause, swap, and resume services on demand, à la carte. This might include streaming video, music, gaming, fitness, education, lifestyle apps, and more all on one bill, through one provider.

This model introduces features that dramatically shift consumer behavior. For example, suspend and resume functionality lets customers “take a break” from a service rather than cancelling entirely. By turning hard churn into softer downgrades, providers protect recurring revenue while giving customers more control.

Super Bundling is not just a new way to package subscriptions, it represents the evolution of the entire subscription economy into a subscriber-first economy, where the customer experience is the competitive edge.

Super Bundling explained: Why telcos are leading the subscriptions hub revolution

Consumers love subscriptions, but don’t love the complexity that can arise from managing them. Juggling multiple services can mean multiple apps, multiple bills, and multiple logins. It’s messy, time-consuming, and for many households, it leads to wasted spend on unused services.

Super Bundling fixes this. By giving people one hub to discover, manage, and pay for all their subscriptions with a single account and bill, it delivers clarity and control. Increasingly, these hubs are being operated by telcos, banks, and retailers who already have established billing relationships with millions of customers.

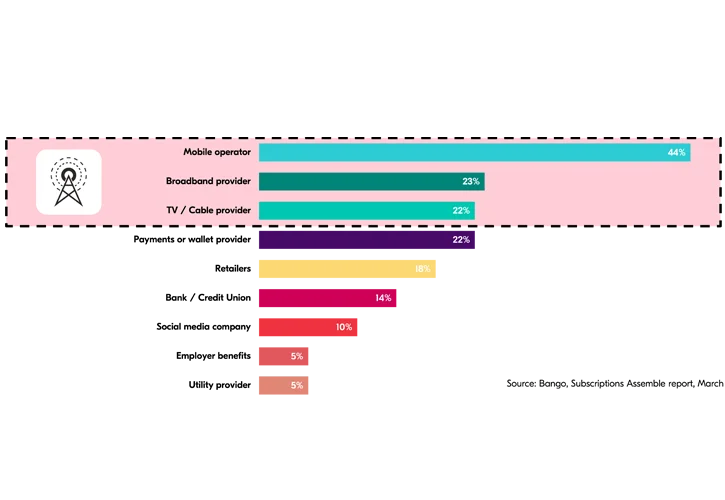

When asked who should provide such a service, subscribers listed telcos as their preferred provider, specifically mobile operators (44%), broadband providers (23%), TV/Cable/CTV providers (22%).Other preference are for payments and wallet providers (22%), retailers (18%), banks or credit unions (14%), social media companies (10%), employee benefits companies (5%) and utility providers (5%).

Why telcos are the natural in-direct subscription channel leaders

Telcos are uniquely positioned to lead the Super Bundling revolution.

- Existing billing relationships: Telcos already have millions of regularly paying customers. Adding third-party subscriptions is a natural extension.

- Trust and scale: Consumers are accustomed to trusting their mobile or broadband provider with sensitive information, including PII and payment details

- Customer base: Large telcos have tens of millions of users ready to access bundled subscriptions.

- Infrastructure: From identity management to fraud prevention, telcos already have the infrastructure in place.

Industry examples prove the point. Optus StubHub in Australia and Telenet in Europe pioneered the hub model, allowing subscribers to choose from multiple services under one roof. While strategies may evolve, the proof of concept is clear: telcos can operate subscription hubs successfully.

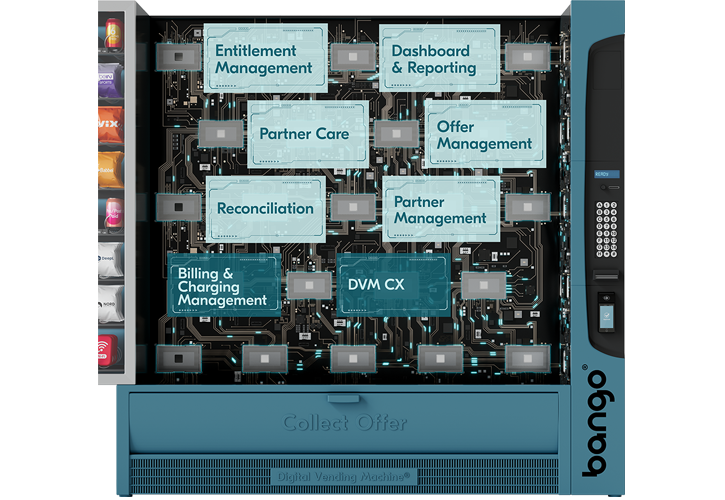

With the Bango Digital Vending Machine®, telcos can deliver these hubs at record speed. Instead of taking 12–18 months to build custom integrations, they can launch in weeks.

How telcos benefit from Super Bundling

Faced with increasing competitor pressure, such as “cord cutting” and price pressure from MVNOs, Super Bundling offers telcos a great way to achieve their many objectives.

For telcos, the opportunity is clear: reduce churn, increase ARPU, attract new customers and become the central gateway for digital life.

How content providers benefit from Super Bundling

Super Bundling isn’t just about telcos and consumers. It’s equally transformative for content providers.

For subscription services such as streaming video (SVOD – subscription video on demand), music, gaming, fitness, and beyond, Super Bundling, particularly through telco-operated hubs, creates new distribution channels:

- Reach new audiences: Access to resellers’ millions of customers (e.g. a mobile operator’s customer base)

- Reduce acquisition costs: Lower CAC by piggybacking on their marketing and billing systems.

- Increase conversion: Seamless onboarding via existing accounts

- Boost retention: Participate in flexible offers and pause/swap functionality that keep subscribers engaged.

Participate in flexible offers and pause/swap functionality that keep subscribers engaged.

For content providers struggling with acquisition, rising churn and fierce competition, Super Bundling opens the door to scalable, profitable growth.

Content providers turn to bundling to overcome market challenges

In the recent Bango survey, ‘Gravity Shift’, subscription leaders reported that: Direct acquisition was reporting lower returns (48%): D2C is no longer a sustainable strategy (53%); they are cutting back on at least one direct acquisition channel (80%), and expect acquisition costs (88%) through direct acquisition channels to rise (88%).

As a result, 91% agree that subscriber acquisition channels now require both direct and indirect channels, 77% say they are prioritizing indirect channels, and 82% plan to increase their spend on indirect channels.

Which indirect channels do subscriptions brands want to work with for bundling and Super Bundling

As 90% of subscription brands are planning to use bundling, it’s interesting to note where they would like to offer their products, when considering indirect channels.

55%

device manufactures (e.g. TVs, CTV)

42%

Telcos and mobile operators

44%

Retailers

44%

Banks and financial institutions

Overcoming launch challenges when launching a subscription hub

Despite its promise, launching a subscription hub for Super Bundling isn’t simple. Common hurdles include:

- Complex integrations and ongoing maintenance: Each new partner brings unique APIs and processes, which can evolve over time

- Offer complexity: Bundles need flexibility seasonal promotions, swaps, upgrades, and downgrades.

- Time-to-market: Custom builds can take over a year, slowing competitive advantage.

- Analytics: Providers need insights on offer performance, subscriber churn, and LTV.

How to get started

Here’s a practical five-step playbook for telcos, banks, or retailers considering Super Bundling.

By following this approach, providers can avoid pitfalls and capture the full value of Super Bundling.

- Define your objectives: Are you targeting churn reduction, ARPU uplift, subscriber growth, or brand differentiation?

- Select the right platform: Choose a hub technology that supports billing, identity, catalog management, and lifecycle features like pause/swap.

- Prioritize partner onboarding: Start with must-have services in video, music, or gaming, then expand to wellness, education, and niche verticals.

- Design flexible offers: Combine permanent perks with limited-time bundles. Let customers experiment and switch, rather than cancel.

- Launch fast, iterate often: Use analytics to measure attach rates, churn impact, and customer satisfaction. Optimize regularly to maximize ROI.

Proof that it works

The momentum is real. Research and market examples show:

- Consumer demand: Nearly 66%% of U.S. consumers would switch or stay loyal to a provider offering a unified subscription hub.

- Operator readiness: Telcos and banks are uniquely positioned to deliver this, thanks to existing billing and customer trust.

- Time-to-value: With Bango’s technology, providers can launch in weeks, not years, keeping ahead of the competition.

Consumer demand: Nearly 66%% of U.S. consumers would switch or stay loyal to a provider offering a unified subscription hub.

Super Bundling isn’t a “nice to have.” It’s quickly becoming a strategic necessity for providers who want to remain central to their customers’ digital lives.

Ready to build your Super Bundling hub?

Talk to us today about the Bango Digital Vending Machine® and see how quickly you can deliver the subscription experience your customers want.

FAQs

It’s the next generation of bundling a subscription hub where customers pay for and manage multiple services with one account and one bill.

They already manage billing, identity, and customer relationships at a massive scale, making them ideal hub operators.

Pause, swap, and resume features let customers take breaks instead of cancelling outright, keeping them engaged longer.

The Bango Digital Vending Machine®, which connects providers to hundreds of services through one integration.

With Bango’s solution, providers can go live in weeks instead of many months.

Simplicity, flexibility, choice, and value everything in one place, with full control.