Finance and phones – what can retail banking learn from the phone business?

by Anil Malhotra

What are the similarities between the retail banking industry and the mobile phone business?

Both increase financial inclusion. Both are the consumer touch point for a new generation of app-centered “challenger” banks. And, both the banking and communications markets deliver two of the world’s most ubiquitous consumer service offerings.

KEY STAT: Almost the same number of people worldwide – 6 billion – have a mobile phone account and a bank account.

World Bank data

Both industries have seen waves of innovation, competition and consolidation, a predictable pattern as markets mature, and products become commoditized.

KEY INSIGHT: The mobile phone industry has simplified people’s financial lives, resulting in the introduction of contactless mobile payments, wallets, and mobile money, QR codes and the use of phones for multi-factor payment verification. What people do with their money is shaping how both industries are building value beyond their core activities of communication and account providers.

How else can the financial and phone companies collaborate and learn from each other to grow new opportunities to acquire, engage and retain customers? This blog sets out our thoughts and how we plan to be a pioneering force behind that growth.

Bango has pioneered two major changes of relevance to both the finance and phone industries:

First with the introduction of charge-to-bill, “pay using my mobile account” for digital content and services, which is now used by over a billion people worldwide via all the leading app stores.

Secondly, with the bundling of consumer subscription services like Amazon Prime, with mobile services as benefits, incentives and rewards. Across the phone and broadband worlds, these offers and bundles have quickly become a “must have” customer proposition.

Can new frustrations = new customers?

There are relatively few reasons why customers should move from their existing banking arrangement. Most commonly, there is either an unusually preferential offer from elsewhere, or unresolved frustrations with the product or service from their current provider.

Banks put a great deal of effort into identifying consumer frustrations with first-party products. Telcos have gone a step further, by understanding what their customers want to do with their mobile and broadband connections. Unsurprisingly, streamed entertainment content is a primary driver of data usage across telco networks. So, what is that customer experience like?

KEY STAT: 49% of consumers are annoyed with the difficulties of managing multiple subscriptions from multiple providers on multiple bills.

Bango primary research, 2024

Financial institutions can take this learning and apply it to their customer experience. If consumers are committing up to 50% of their monthly household budgets to recurring payments, how do we make this consumption pattern better for them?

Banks are in a powerful position to influence consumer attitudes by bringing together all their customer’s subscriptions in one place – making the subscriptions experience simpler and friendlier. Better still, it allows you to match new subscription products and offers to individual customer needs, multiplying the reasons why customers stay connected through your app and web services.

KEY STAT: 58% of consumers would switch from their existing provider (e.g. bank, telco etc.) to another if it offered them a single place to access, pay for and manage all their subscriptions.

Bango primary research, 2023

Stand out from the crowd

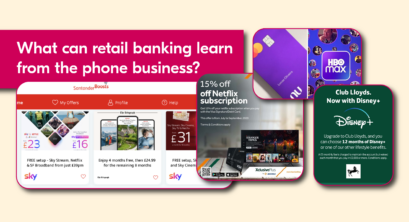

Using subscription services to catch a consumer’s eye is not a new marketing tactic for banks. But like any customer program, there are ways to optimize the success of subscription offers.

KEY INSIGHT: Make your offer stand out – give consumers choice… simply offering Netflix on its own doesn’t convert as well as Netflix in conjunction with other VOD and subscription services. Ensure you can move fast to present the latest, most creative offers.

In most markets you can be certain that over half of your customers will have more than one subscription already. Choice is therefore the driver of both engagement and conversion.

KEY STAT: Analysts expect 1 in 4 subscriptions to be acquired through a hub provided by a bank, telco or retailer by the end of this decade. In some markets (e.g. Latam) this could be as high as 1 in 2 consumer subscriptions.

Omdia, 2023

Boosting customer value

Consumer spending is increasingly subscription based. Across entertainment, health, education, retail, insurance, transportation…. subscriptions are everywhere. Where one-off payments present little opportunity for a bank to add value, in ‘subscriptions management’ there is a significant opportunity to create meaningful value for most of your customers.

KEY INSIGHT: Consumers like subscriptions because they guarantee continuous availability of the service and predictable cost.

Boosting customer value is a two-way transaction – the goal for banks is to increase the value of the business from their existing customer base, while the banking customers want something back, they aren’t already getting.

KEY STAT: Net Promotor Score (NPS) increases in direct proportion to the number of subscriptions per user. High NPS means higher product satisfaction means greater service adoption.

Parks Associates, 2024

There are three ways in which banks benefit from becoming involved in customers’ subscription lives:

- Solving a customer pain point builds a positive customer relationship – increasing retention

- By increasing the number of activities that customers manage through their bank it becomes easier to upsell additional banking services – credit and borrowing arrangements, foreign currency, insurance products etc. – increasing LTV

- Direct, incremental revenue from subscriptions sold

KEY INSIGHT: Based on telco findings, consumers that manage their subscriptions through their telco are (a) more likely to have multiple first party services from their provider and, (b) deliver higher than average revenue per customer

Omdia, 2023

On top of the gains through additional banking service revenue and increased customer satisfaction, the third benefit arises from subscription revenue incrementality. In a go-to-market model taken directly from the telco world, subscription providers will give up a share of their direct revenue to acquire new customers and increase the lifetime value of existing customers.

This represents a direct revenue opportunity for banks and – for many customers. The impact is realized by upcycling the passive nature of a current account relationship across a large proportion of the customer base, currently producing low or no revenue, to a much deeper relationship that adds a new revenue stream derived from an increasing source of consumer spending.

KEY INSIGHT: By offering a curated or targeted list of subscription services, banks can drive additional sales with payments automatically coming from the customer’s bank account or credit card. Adding multiple subscription services as ‘super bundles’ allows you to offer additional benefits and rewards.

Higher engagement, greater loyalty, longer retention

On the flip side of the satisfaction coin is engagement. In industries where entry level products differ only in name and brand, customers have few reasons to talk to you.

Borrowing again from the communications world, telcos have cleverly leveraged customers’ fondness for subscriptions to find multiple engagement points. For example, handset upgrades, add broadband to mobile, top-up prepaid account, switch from pre to post paid, add a family member, upgrade to household plan etc. In each case, to augment the benefits of adding the first-party service, telcos provide a visible, high conversion third-party service offer to engage the customer with the first-party upgrade.

How can these types of consumer behaviors be mapped in the banking world? Subscription offers can be linked to a wide range of focused consumer engagement activities, including:

- Pay a fee for our executive membership account (increase LTV and increase retention with paid member benefit accounts)

- Increase digital intensity in the app (discover, interact and manage subscriptions via the app)

- Pay salary into the account each month (rewards based on desired monthly/weekly behavior)

- Spend more using your bank account or credit card (top spenders gain additional subscription benefits)

- Move excess funds to savings account (we’ll add Uber+ to save you even more)

- Take out a credit arrangement to fund purchases (get Deliveroo/Deliveroo/Pret Club/etc. on us)

- Switch your mortgage to us and we’ll fund your home entertainment subscriptions for a year (Netflix, Disney+, Prime Video, Paramount+, Max, Peacock etc.)

KEY STAT: Third-party subscription offers contribute to a 60-70% reduction in customer churn.

Verizon

KEY STAT: 67% of consumers are more loyal to telcos that help them manage subscriptions.

Bango primary research, 2024

The most persuasive argument against doing anything with a bank account is “all banks are the same”. How you challenge this belief comes down to two things: what you are prepared to do to challenge that belief; and whether anyone will notice.

Taking the plunge

Some banks fall back to affiliate schemes and voucher codes to bring subscriptions to their customers. These are often perceived as an easier equivalent to subscriptions bundling. However, offers based on consumer actions such as voucher redemption fail to deliver high engagement because they give-up the recurring customer relationship to the provider of the subscription service. Retaining that ownership brings clear value to the bank and delivers repeat opportunities to communicate, engage and upsell.

Get ahead in the market

To find out how you can create a Super Bundling experience to grow your customer base, contact Bango today at info@bango.com.

Subscribe to our newsletter

Get the latest subscription bundling news and insights delivered straight to your inbox.